America Is Crashing Like Sri Lanka Did, Hopefully Worse

Americans are currently experiencing something entirely foreign to them. Consequences. As a confused person from CNBC already noticed, “Stocks are down, the dollar is down, and bond yields are higher. This is incredibly odd for the US.” As someone who has lived through total economic collapse in Sri Lanka, yes, that's how it works. Your economy totally collapses. The newsletter also said, “This is the uncomfortable position developing markets can often face in a crisis,” and also yes, America is a rapidly undeveloping country. Get used to it.

As I said back when Sri Lanka crashed,

Sri Lanka is just the canary in the coal mine. We followed neoliberal economics in the 1980s just like you did. We settled for cheap consumer goods instead of producing things. We covered up our trade deficits with loans, and by the 2010s we were using one credit card to pay off another.

Collapse on the periphery of White Empire and collapse within is one process. When it reached America was just a timing difference. As I continued,

If you sit in judgment of Sri Lanka you’re really missing the point. Don’t you use dollars and petrol and liberal democracy too? Aren’t they feeling shaky to you? As Warren Buffett said, “when the tide is out you see who’s swimming naked.” Sri Lanka was certainly swimming naked, but as any Sri Lankan can tell you, if the tide suddenly rushes out, that means a tsunami's about to come. A money-print swimsuit might cover America’s nakedness for now, but it won’t protect you from the flood. As someone who’s already been swept away, let me warn you as only a ghost can.

Boo!

The fact is that, on paper, America is a more shambolic economy than Sri Lanka's. As I said, “America has a worse debt to GDP ratio than Sri Lanka. Everybody is levered up the ass, betting on a future that will not come to pass.”

Now it looks like American elites have decided (through some combination of stupidity and malice) to control demolish themselves as a center of world trade. This has started America's Greatest Depression, preceded by a short gilded age for insider traders. It's the end of the world as Americans know it and, as REM said, I feel fine. Or a twice condemned man said to another at the gallows, first time?

Tariffs Vs. Taxes (Same Thing)

The proximate trigger is for the Greatest Depression is tariffs, one of the few tools a President fully controls on his own, besides all the actual triggers. The Federal Reserve is not part of the federal government (it's a private banking cartel), and Congress technically holds the purse strings. Tariffs are the only trigger a President can pull all on his own, and Trump is trigger-happy to use them. He's holding the whole world up in a murder-suicide pact, unless they buy more Teslas or something.

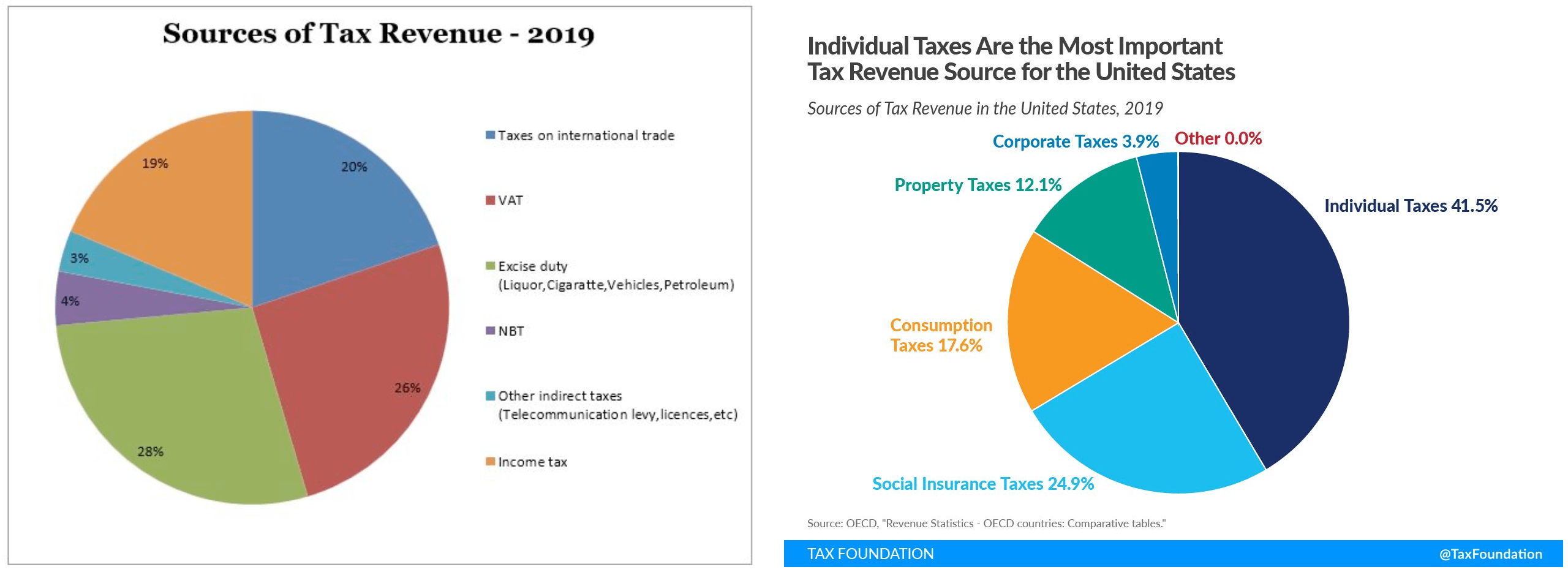

This obviously isn't working, but the latest explanation is that tariffs will allow America to replace income taxes for people making less than $150,000. I'll indulge this because it's hilarious. You know who else collects taxes this way? Sri Lanka.

I have often called Sri Lanka a kade (shop) with a port attached. We tax everything coming in (tariffs) and effectively double tax everything being sold (VAT, excise) and that's our revenue model. People barely pay income taxes at all. This tax policy retards both consumption and production, because exports also require imports. This is not a good tax policy. It doesn't work.

Now, however, we see America barrelling down the same dead end we just died in, as we try to turn around. It doesn't even make sense. Why are they trying to be like us? Sri Lanka is still colonized by western capital and we did whatever we could to keep the lights on. But America is western capital. They don't need to do this. We would keep sending them our work and resources and they can give us magical paper in return. They don't have to tariff us to death, they're just killing their own golden goose. But for reasons we'll discuss, here we are.

America is becoming a poor country like Sri Lanka by attacking poor countries like Sri Lanka. Trump thought he could eat the developing world, but someone should tell him, you are what you eat. Sri Lanka vomited up its economy, and America is about to hurl out its hegemony.

LKR Vs USD

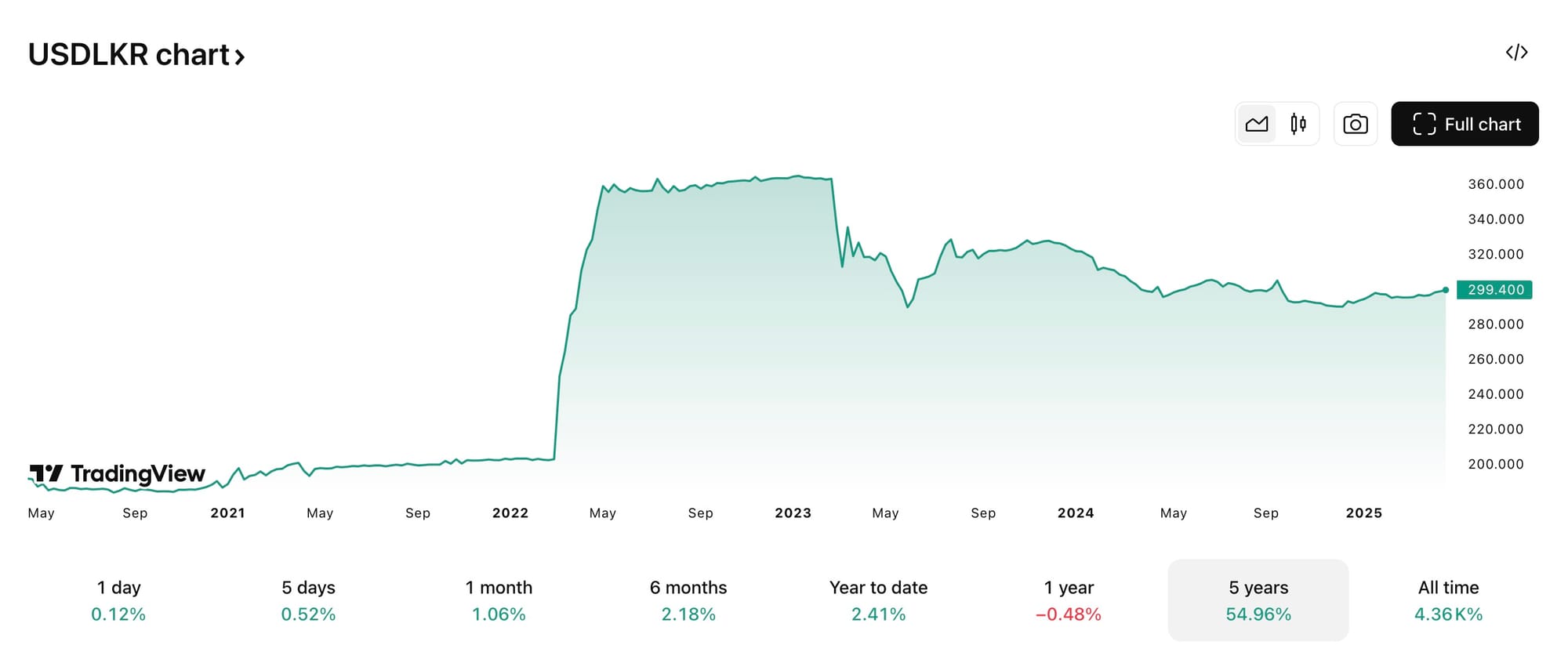

When Sri Lanka's economy collapsed, the first thing I noticed coming up was the currency. It rapidly depreciated from 200 to the dollar to 350, a 75% increase (from our perspective). People's savings were nuked and prices still haven't recovered.

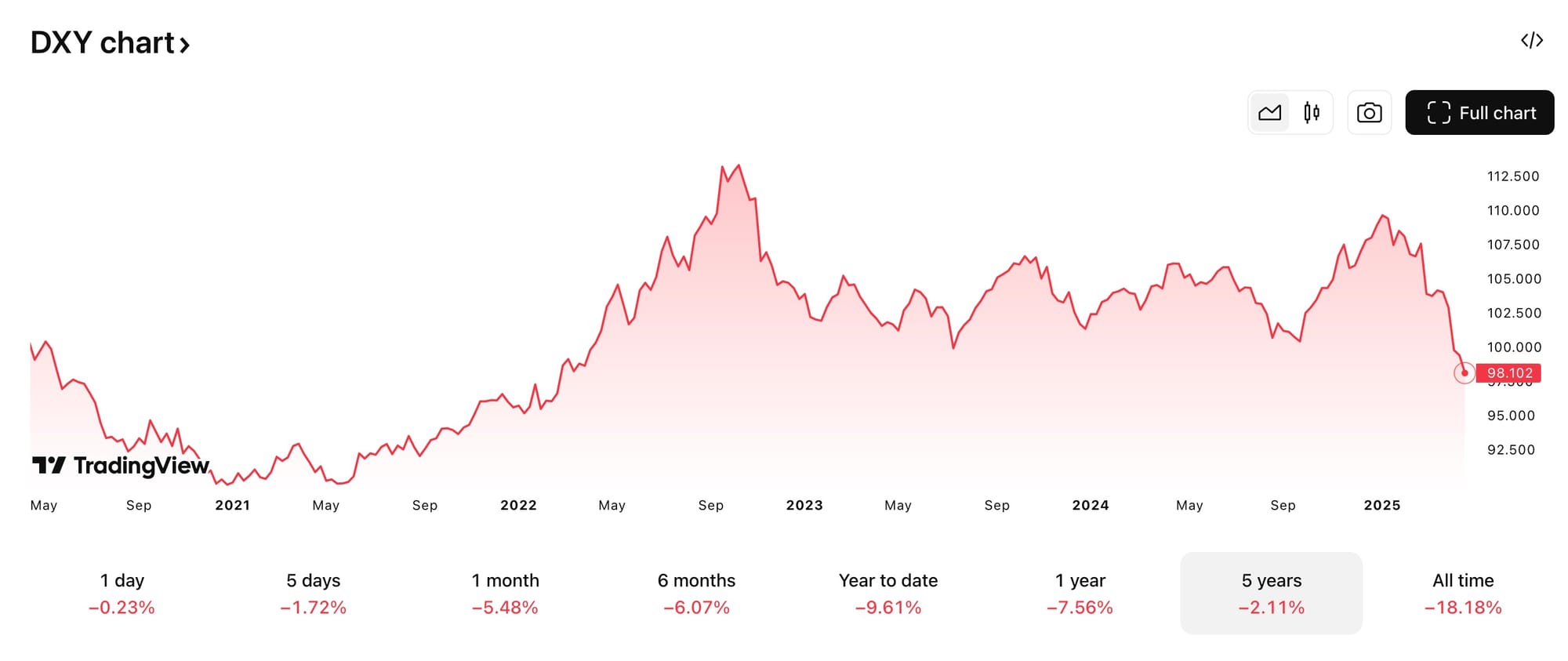

In the same way, America's currency is depreciating now (relative to its vassals) and barely appreciating against its debt slaves and enemies. The currency is burping much less than Sri Lanka's, but this is a much bigger problem. The US dollar is a reserving currency and people are supposed to flock to it during a crisis. Instead, it's going sideways or down. The problem is not the magnitude. This isn't supposed to happen at all.

Besides going against history, this is also going against the future whole plan. I know it's surprising that there is a plan, but in 2024 current adviser Stephen Miran published A User’s Guide to Restructuring the Global Trading System, which we have covered previously. Trump is following it as much as he follows anything. Miran's plan at least makes predictions, which we can at least check posthumously.

Miran's plan said that tariffs would pay for themselves because they'll damage foreign currencies more. He said, “the economic and market consequences of tariffs hinge on the extent to which they are matched by offsetting changes in currencies.” The idea is that if you tariff country X at 10%, their currency depreciates by 10%, and the US importer would actually save money. Because the US dollar would be stronger, and everyone else would be weakened. Miran's thesis was that, “tariffs are ultimately financed by the tariffed nation, whose real purchasing power and wealth decline.” Now, however, the feces has hit the fan and the opposite has happened.

The US dollar has depreciated against its vassals (measured through DXY) and has barely appreciated against people like China and Sri Lanka (which got tariffed the most). For us two, there's been barely 1% currency movement against 50-150% tariffs, which offsets nothing. Of course, Sri Lanka's tariffs are currently suspended down to 10% and China's have been largely circumvented because Trump caved, but nothing like Miran predicted has happened. The math doesn't math because the mathematicians are mendacious morons, telling a mad king what he wants to hear, which is madness.

Bonds Vs Stocks

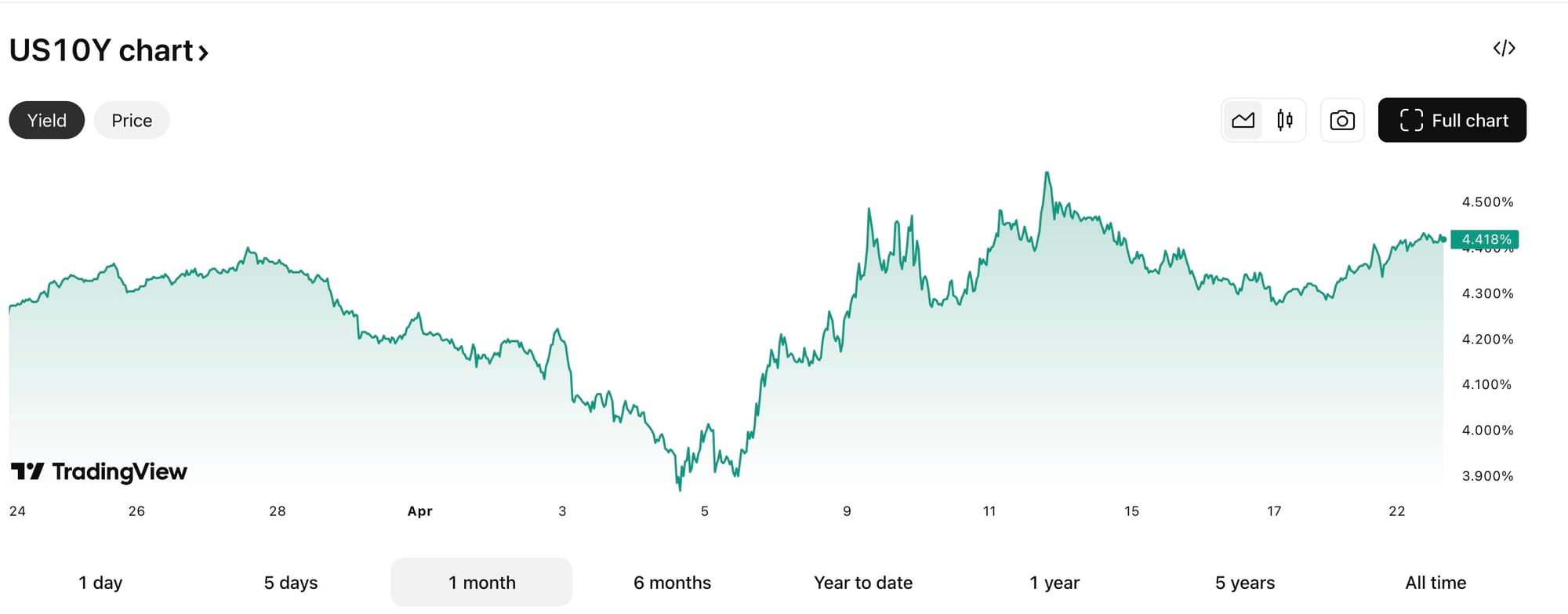

US bonds, also, are not supposed to move like this. They are in fact moving like Sri Lanka's bonds during our collapse, ie junk nobody trust and which the government has to pay a premium for.

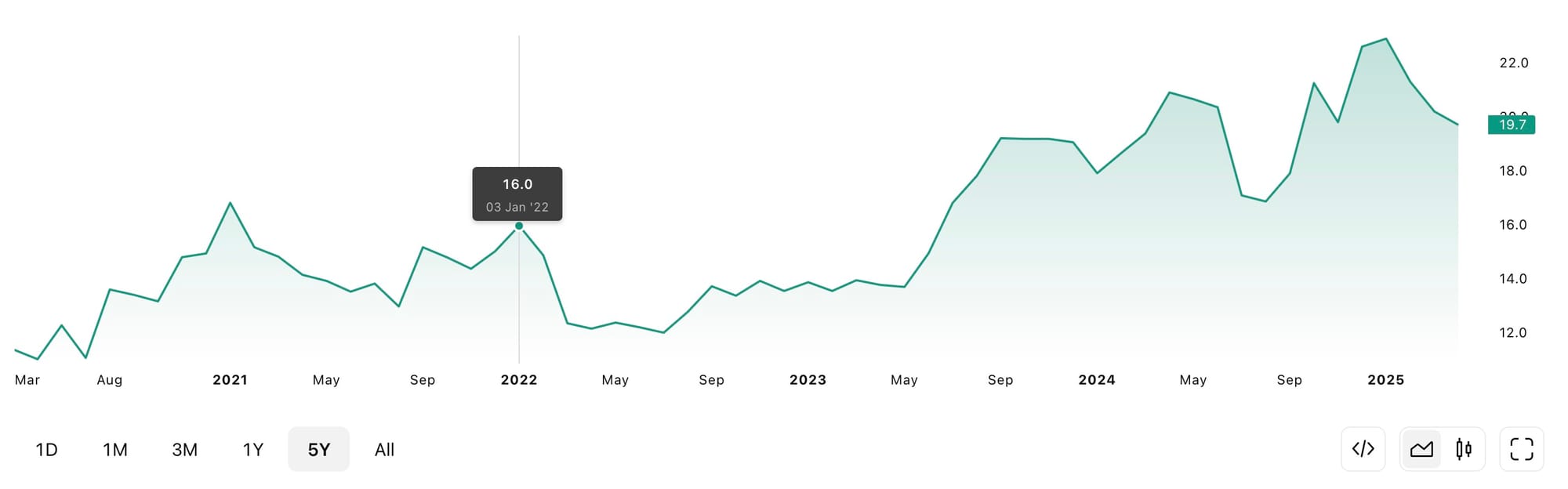

When Sri Lanka defaulted, bond prices went down, because there was no demand for broken promises. That meant yields had to go up, to attract new bondholders. So yields went up to 30%, while bond prices (the tradable value) went down. Bond prices move inversely to yields. That's basically a rule.

Not a rule, but a rule of thumb, is that bond prices generally move opposite to stock prices. If stocks are risky, people retreat into safe bonds. Because Sri Lanka's economy had totally collapsed, however, all bets were off.

In Sri Lanka's collapsed state, stocks and bonds went down together (starting in January 2022) and recovered together (starting in June 2023). Stocks and bonds are supposed to move inverse to each other, but in these perverse conditions, they move together. This is what happens in a total economic collapse. This is what's happening to America today, while they're dazed and confused. ‘What are we, a bunch of ASIANS?’

Like USD depreciation, stocks and bonds both crashing is not supposed to happen at all. It's one of the horsemen of the financial fuckupalypse. As our CNBC newsletter says,

Go back to the financial crisis, to Covid, to anytime there's a whiff of panic about a slowing economy and what do you see? Stocks are down, yes, but the dollar shoots higher as global investors pile into safe havens, and U.S. Treasury yields drop sharply. This reaction can be helpful--it cushions the economic blow. Lower Treasury yields mean falling mortgage rates, falling borrowing rates, and so forth. A stronger dollar gives U.S. consumers more purchasing power, so imported goods are cheaper. But now, we're not getting that.

Americans are used to every crisis being an opportunity (for the country), but this is just a crisis. Let's look at stocks and then bonds, and see how it's all gone wrong.

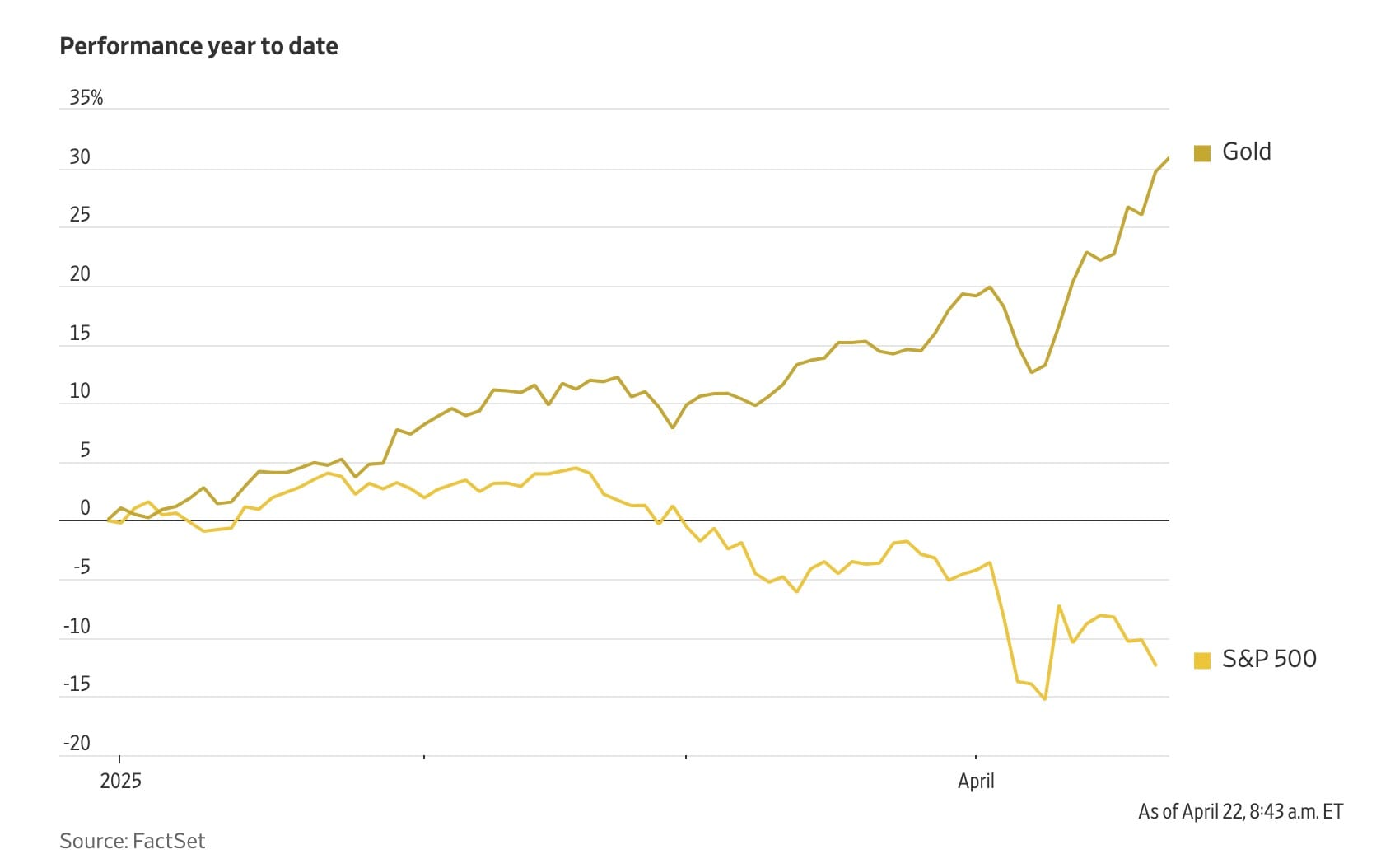

The S&P 500 (as an index of American stocks) is going to shit, so investors should be fleeing to safer bonds (thus lowering their yield, because high demand). But that's not what's happening.

Bond yields are going up, which means there's less demand. This inverts the usual relationship described by C. Broadus in 1993 when he described stock market wobbles. He said, “Gs up, hoes down while you motherfuckers bounce to this.” Gilts are supposed to go up when stock holdings go down. But that's not what's happening here. The whole thing is going to the dog pound.

And this isn't even the Chinese weaponize their treasuries, it's the Japanese stabbing their masters in the back. Anecdotally, it's the Japanese dumping. Even the most vassalized, atomized allies don't trust the US treasury. They're voting with their money and just fucking off. As Shakespeare's famous stage directions read, “Exit, pursued by a bear [market].”

Fiat Vs. Gold

So where's all this capital going, if it's not safe in the capital of capitalism? One clue is again behavior of Sri Lankans, or just Asians in general. Asians buy gold all the time, but especially when they're stressed. The default investment thesis is ‘what can I fit on my wife and flee for my life with.’ Now even professional investors are acting like Asian aunties before their daughter's wedding. They're stacking up on gold and keeping it close.

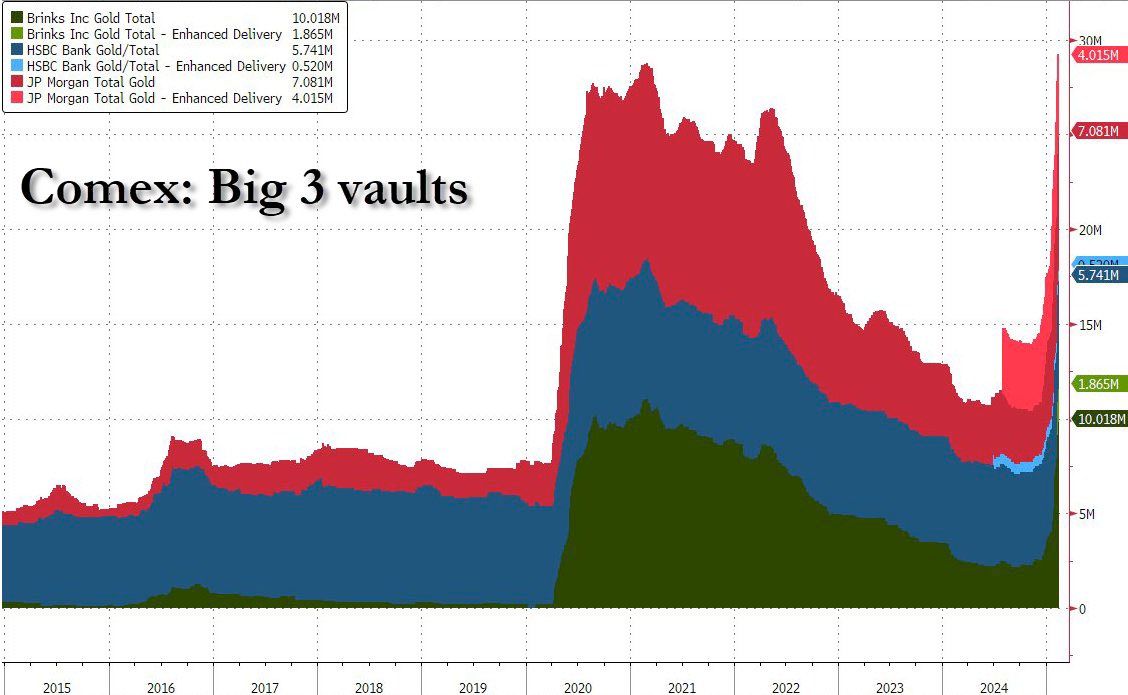

Gold prices are going up now, but physical gold was flying from January. Huge amounts of physical gold was airlifted to New York before the crisis hit, meaning that the smart money knew what was coming. Physical gold storage today is at higher than during the COVID collapse (still happening btw), meaning the sphincter of global capital is clenching tight. The big banks are not content with paper claims on gold, they want physical gold and they want it on site.

I'm not saying the world is going back to the gold standard, none of this is investment advice. All I'm saying is that the world economy is getting real very fast, and people have stopped being polite. For a long time, China and the smartest money has been stocking up on physical resources in general—gold, silver, grain, oil—things you can hold on to when matters get out of hand. With Trump completely out of pocket, perhaps now you understand.

The era of fiat currency that replaced the gold standard is over. The dollar was only backed by the faith and credit of America, and both have been toasted. Americans, in addition to being evil, have become unpredictable. Investors can forgive the genocide and the wars, but threatening their money is unforgivable. Today America as a vehicle for all your hopes and dreams is looking like a plain old Fiat, not that big, not that safe, and full of clowns.

Great Idiot Theory Of History

As I've elaborated in my Great Idiot Theory, material conditions create probabilities for change, while great men and great idiots create the volatility. In Sri Lanka, for example, our economy was structurally fucked since we neoliberalized in the 80s, but it wasn't until a Great Idiot did a few random things in the 2020s that it all went crazy.

Before the crash, President Gotabaya Rajapaksa had a few bad ideas (cutting already meagre income tax and banning chemical fertilizer quickly) which had big, disproportionate effects. These ideas certainly weren't as bad as the neoliberal ideology of decades, but they spooked the markets (with some help from spooks) and caused cascading capital flight. That's all it takes for a market crash. Just a few dumb stomps and you get a stampede.

In the same way, America's current President is stomping around like a literal bull in a China shop, and capital is fleeing. What I call the Greatest Depression has already begun, with the spark lit by a historical arsonist who'll likely profit from the fall. And that's really the question you should really be asking, cui bono? Who benefits?

Cui Bono

Historically, America does not care if countries collapse and in fact enjoys it. Chaos is a ladder, and as a reserve currency, they're at the top. When countries like Sri Lanka collapse, capital rushes back into safe USDs and USTs and they suck up resources and slaves for pennies on the dollar. Every crisis is an opportunity if you're an opportunist. America is full of what southerners called ‘carpetbaggers,’ now paired with carpet-bombers for good measure.

Historically, America also does not care about Americans. Remember that America was founded by the property, for the property, everything else is just marketing. America is run by a malevolent AI called Capital, with human shareholders as interchangeable parts. The American economy has never been about the greater good and is always down for a little cannibalism. If there's some incentive to blow things up, they love a little controlled demolition. Which may be what's happening now.

If the American economy goes down slowly, there's just a lot of money to be lost. If it goes down quickly, however, there's a lot of money to be made. On just the whipsaw movements of the last few weeks, people made millions if not billions of dollars. As Trump proudly said in the Oval Office after the first big crash, “He made $2.5 billion today, and he made $900 million.” He literally pointed the crony capitalists out, they don't give a fuck.

Trump has perfected an entirely new form of financial fraud, the dump-and-pump. They dumped the whole US economy and then pumped it with a tweet, to make a quick buck. What Nancy Pelosi made in decades of insider trading, he'll make in one term. Never underestimate the motivation of greed. It's what America was founded on.

Consequences

As someone who has lived through a total collapse, I can tell you how it played out for us. We had two years of unelected government where they stole as much as possible, with the IMF making sure foreign crooks got their taste first. I saw the rich somehow get much richer while the poor suffered and starved. This seems to be the modus operandi for capitalist crashes, and the POTUS is a known operator. Donald Trump has crashed multiple businesses over the years and come out ahead, why not crash a whole country, or the global economy while you're at it?

When Sri Lanka finally had an election we elected a nominally socialist government, which is still doing much the same things, because our freedom is so limited and unwon. But I don't think America can vote their way out of this, and I hope they don't. In fact, I hope America crashes so completely that it just disappears as an entity, an identity, and as an enemy that holds deaths and debt over everyone. Sri Lanka's debt payments resume in 2028… unless the people we owe money to disappear first.