How, Financially, We’re Fucked

As I discussed in How, Precisely, We’re Fucked, capitalist civilization is simply running into physics like a brick wall. Capitalism is also running into math, which is even more impenetrable. You cannot keep growing forever on a finite planet and you cannot decouple growth from energy. Something’s got to give and it’s not going to be math. It’ll be the capitalist civilization we live under. When will this great financial crash happen? Historically speaking, it’s already begun.

Borrowing Against The Future

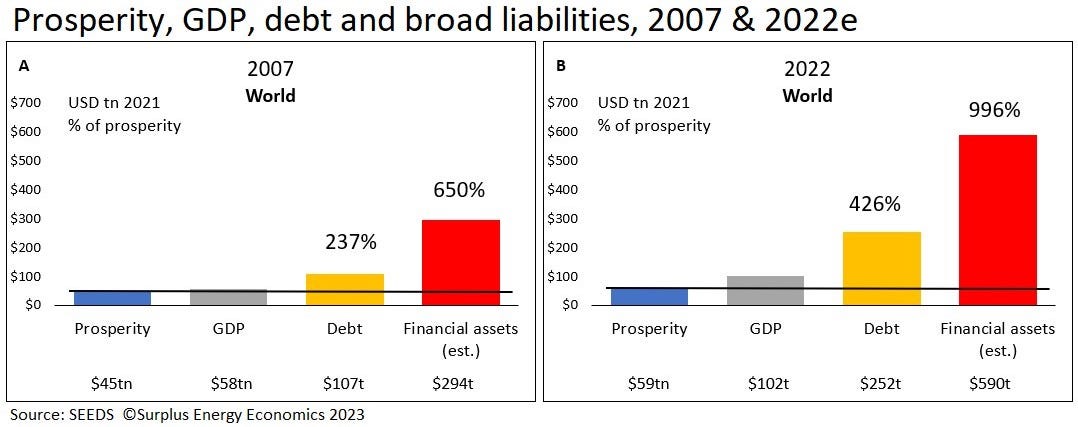

From 1997, every dollar of GDP (🤮) growth was bought with $3.60 in debt. Since 2007, that leverage has increased to $7. All of that debt is borrowed against future growth (someone to pay this 7:1 bet), but as you can see, future growth is only slowing down. For two reasons.

- We are running out of cheap fossil fuel energy and every additional drop is more expensive, rapidly getting to the point where it costs more to drill/kill-for than it’s worth.

- Our general pollution (not just CO₂) is destroying our ‘capital’ base, ie the Earth we live on.

Capitalist civilization is like an F1 car which is both running out of gas and running through the stands, mowing down people. Would you bet on this car? Well, guess what, you already are. If you have a pension or investments that’s what you’re betting on. Future returns from a future that’s completely fucked. These returns are not physically or mathematically possible, nevermind the ethics we were warned about centuries ago. Note that these figures come from Tim Morgan’s excellent series, which has graphs and sources and stuff, look for yourself. As he writes:

Whilst GDP increased by 50% between 1997 and 2007, debt expanded by 77% over this same period. Essentially, each dollar of incremental GDP was being bought with $2.40 of net new debt, whilst 54% of reported “growth” was the cosmetic effect of credit expansion. This led directly to the global financial crisis (GFC) of 2008–09, an event caused by a combination of breakneck liability expansion and the proliferation of dangerous financial practices.

This time around, the leverage effects have been even worse, with each dollar of “growth” between 2007 and 2021 bought with $3.60 of borrowed money, and reported “growth” has been even more cosmetic, with fully 64% of it ascribable to credit expansion. More worryingly still, broad liability expansion averaged an estimated $7 for each dollar of “growth” between 2007 and 2021. Much of this can be ascribed to the non-bank financial intermediary (NBFI) or “shadow banking” sector, which is very largely unregulated.

I use the ‘broad liability’ figure because it is the shadow banks which are most likely to explode. They’re the ones who devoured my country, Sri Lanka, using the IMF to starve our children while they take their pound of flesh. People point to Sri Lanka saying that we can’t pay our debts with our economic activity, which is true. But you can’t pay your debts either.

America has a worse debt to GDP ratio than Sri Lanka. Everybody is levered up the ass, betting on a future that will not come to pass. The whole fossil fuel coal mine is blowing up, and Sri Lanka is just the canary that croaked first. The fact is that imperial economies have already crashed, in 2008. It’s just that they—unlike Sri Lanka—were able to print money and paper it over. But that’s a band-aid over a mortal wound. The bubble they call an economy is just getting more and more inflated, causing even more chaos when it finally explodes.

This is all borrowing against a future where there will magically be more money to pay off all these bets. But um, how? As Tim Morgan says, “we have reached a turning-point at which economics and the economy have parted company.”

Debt is just a bet against future cashflows, and the future looks total shit. As Morgan puts it, debts are calls against future energy flows, and we simply don’t have energy as dense and rich and fossil fuels anywhere on the horizon. So these debts cannot be paid.

The truth is that we are running out of fossil fuels at the same time that they’re killing us. It’s just a race to see what kills us first, running out of heroin or heroin. The withdrawal pangs have already started. We’re facing a pandemic that never really ended, what looks like World War III, and a climate that’s physically collapsing around us, and money-lenders still want to get paid as if things are getting better and not worse.

People from 2010—which was relatively idyllic—are expecting to be paid out from cashflows in the 2020s—which is total shit. And they want to get paid 7:1. The math just doesn’t work out. Bankers have borrowed against the future at the same time that they outright robbed it of resources. This worked as long as the future was in the distant future, but now it’s suddenly now.

Economic Idolatry

Economics is not a science because A) its core assumptions (rational actors, infinite growth) are either unproven or provably false and B) they ignore all other science and just talk about money. As Morgan says“orthodox economics, makes many fallacious assumptions. One is that the economy is entirely a financial system, not constrained by energy, resource or environmental limitations. Another is that the economy can grow in perpetuity, notwithstanding the limited physical characteristics of the Earth.”

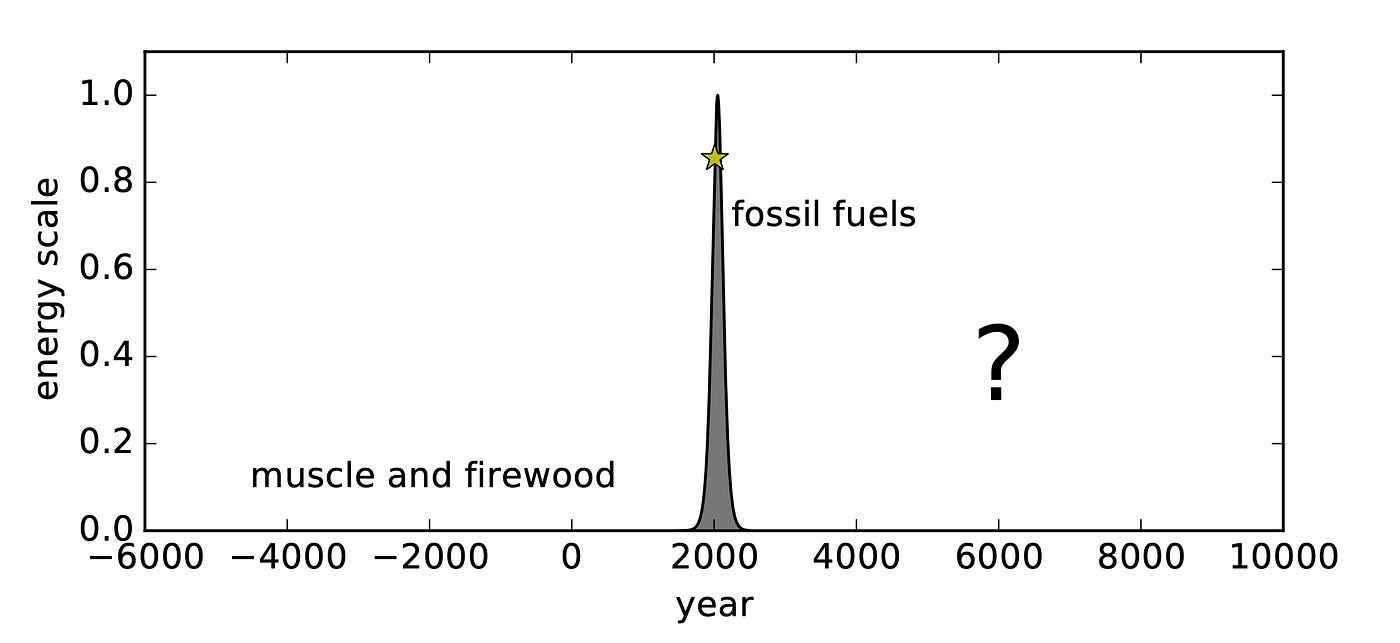

Economics, however, dominated the actual sciences (nevermind superior indigenous wisdom and wiser religions) because it worked. It really did produce miracles—cars, flights, fruit out of season, talking machines, vibrating plastic dildos. It said it produced all of this out of wisdom, but that’s not true. It was all fraud. All of that growth was borrowed from the past, with the costs dumped on the future.

All of the rapid growth in the economy is actually driven by fossil fuel energy stolen from the past. The costs of all this are dumped into the future, as emissions which choke the planet and expectations that cannot be met when these non-renewable resources run out. As I (via Tom Murphy) discussed in How, Precisely, We’re Fucked, fossil fuels are a historical blip of massive energetic growth and economists have no idea what to do when the fossil fuels run out.

Economist are just like ‘replace it with renewables and keep growing’. This ignores the 800 other kinds of pollution and destruction which will kill us with something besides CO₂. You simply cannot have infinite growth of any kind on a finite planet (re: cancer), but economists don’t do math or science. They do economics, which is none of the above.

The Bifurcation Of Reality

What economists produce is a lot of fancy math to obscure basic arithmetic. Something that grows at 2% a year doubles every 35 years (divide 70/growth rate to find doubling time). Something that keeps doubling will eventually overflow its petri dish or planet. It will in fact overflow from a petri dish to a planet, that’s how strong exponential growth is. And economists want us to do this forever. It’s just not mathematically possible.

This impossible belief in infinite growth is the center of modern reality—all pension plans and mortgages and investments and interest rates—but it’s running into the physical reality of the future right now. While it is possible (unlikely) that we could mitigate climate collapse, we cannot avert financial collapse. It is simply impossible to meet the expectations of people that expect the impossible.

As my homie Morgan says,

Surplus Energy Economics has never predicted that the economy somehow ‘must’ collapse, noting that the rate of decline in prosperity is comparatively modest, and could be manageable. Recognition of the energy dynamic of prosperity erosion does not compel anyone to join the ranks of the collapse-niks.

But the financial complex, rather than the economy itself, is where real and extreme systemic risk does exist. We might be able, to put it colloquially, to ‘get by with less’, but we cannot ‘meet our commitments with less’. Much of this is a result of ignorance (about the real workings of the economy), intentional denial and limitations in oversight.

We could theoretically feed and clothe our children in the poorer future, but we cannot do so while paying of the bankers who simultaneously bet on and stole from future generations. Sri Lankan children are already starving to satisfy your bankers’ greed, but this fate will come to all of us soon enough. They can only continue the planetary Ponzi so long.

The fact is that the philosophical destruction of older, balanced civilizations and literal denigration of wiser peoples set this off. The erection of economic idols enshrined greed as ruling dogma. Pour literal oil on this fire and this is what you get. The ashes of the future in the now.

Hence the next item in planetary Bingo (after pandemic and land-war in Europe) is financial collapse. A motherfucking big one. All of the fraud of the 2008 collapse inflated into even greater proportions, with no tools left to pump the bubble up anymore. And so, inevitable, it will pop. Taking down not just banks (already happening) and people (already fucked) but entire currencies, including ‘safe’ imperial ones. The people at the core of White Empire (America, UK, EU) are in fact the most levered up and the biggest frauds. The trouble with seeing these bastards justifiably fall is that we are almost all in the White Empire and their greed will collapse on everyone, hitting the poor and undeserving the worst of all.

Capitalism is running into both physics and math, and you can only bifurcate from reality for so long. They have borrowed against the future, and the future has come to collect. Historically speaking, right now.

I am not even attempting to summarize, but you can find these general points much deeper illustrated in Tim Morgan’s magisterial series, The Surplus Energy Economy, parts 1–5.