WeWork Is Stupid AirBnB

And now they want your money

The WeWork business model is literally stupid AirBnB. Imagine if AirBnB paid all of their hosts rent — whether anyone booked a room or not. Imagine that AirBnB also paid for home improvements — to houses they didn’t even own. That’s the WeWork business model, except for office space. It is as stupid as it sounds.

This model has understandably not proved profitable during past 9 years and their prospectus¹ says “we cannot predict whether we will achieve profitability for the foreseeable future.” However, Softbank has already pumped billions of dumb money into it so retail investors are like:

$$$$$$$$$

¯\_(ツ)_/¯

But WeWork isn’t a tech company, and it certainly isn’t AirBnB, a company with many quarters of profitability. WeWork is just what $12.8 billion looks like if you light it on fire. It looks like an energy source but, no, it’s just money on fire.

The Rent Is Too Damn High

To use the AirBnB analogy, the fundamental problem is that WeWork pays rent. 15 year leases in most cases. No matter what happens, they have to pay the rent. To quote Goodfellas — Recession? Fuck you, pay me. Lost a tenant? Fuck you, pay me. You get the picture.

There’s a reason AirBnB doesn’t rent property itself. This is not how the ‘sharing’ economy works. These companies do everything to get capital and labor risks off their books and to distribute it across other people. With WeWork the risk is just sitting there. The landlords get paid and the tenants get flexibility, but shareholders are left holding the bag.

WeWork also pays to fix up the spaces to make them cool. And they do look really cool. The company gets a bit of money from the landlords, but in 2018 they directly paid for $1.38 billion worth of fixing up other people’s property. They call this an investment but, no, it’s still OPP.

I won’t even get into why AirBnB doesn’t pay to remodel your bathroom. This is so stupid that no one would ever think of this. WeWork has had 9 years to show that this is somehow different for office space and, no, it’s still stupid.

Dodgy Accounting

When I was running a startup we had some tough times. I used to open a spreadsheet and subtract expenses (rent, engineering salaries, bills) until we became profitable on paper. This was pointless but it made me feel better. This is literally how WeWork does their accounts.

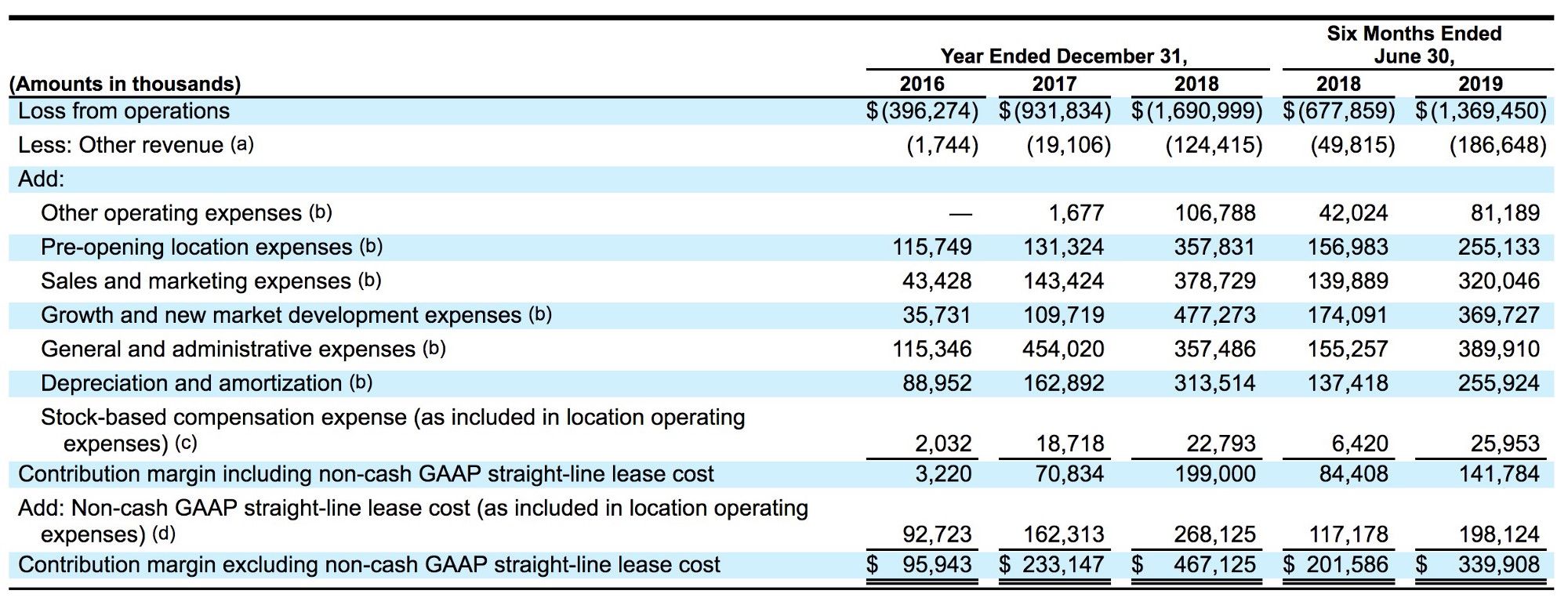

In the ‘accounts’ above, WeWork tries to spin a $931 million loss into a $233 million gross profit. They do this by subtracting all of the relevant expenses, including the rent costs. Now, this is a bit in the weeds, but in acceptable accounting, the rent cost is averaged out (straight-line). So maybe you get 2 months free and the rent increases 10% each year. That all gets averaged out.

WeWork doesn’t want to do that. But the thing about Generally Accepted Accounting Principles (GAAP) is that you don’t get to decide, because then everyone would cook the books more than they’re already doing. What WeWork calls ‘contribution margin’ is as vacant as my depressed spreadsheet doodles. You should just close that spreadsheet and never show it to anyone, nevermind including it in a prospectus.

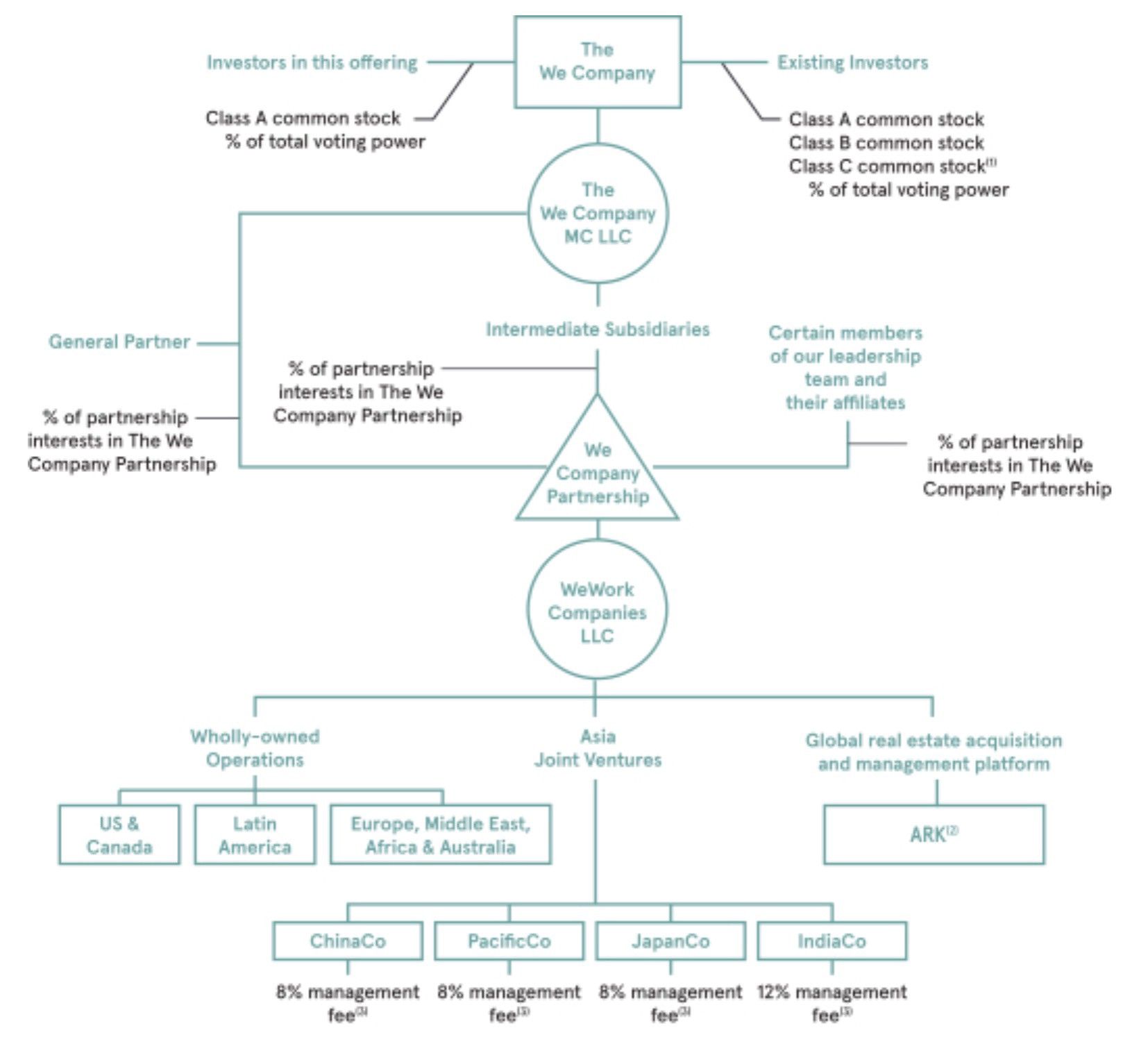

Also note that, 9 years in, this giant company has no audit committee. Furthermore, behold its byzantine and baffling corporate structure:

Dodgy People

If WeWork was a country, it would be flying a big red flag. WeWork is effectively run by a husband and wife team (bad sign) and the husband Adam Neumann has a voting majority (terrible). Neumann draws no salary (bad sign) and has no employment contract (terrible).

Neumann has drawn hundreds of millions of loans from the company, has rented the company property, and even sold the company its name for nearly $6 million (Bloomberg). As the company is about to go public he has cashed out nearly $700 million, a seeming record and, again, not a good sign.

This is almost minor, but the prospectus discloses that he may have violated the Securities Act by giving interviews. Meaning “we could be required to repurchase securities sold in this offering.”

This whole thing looks like a corporate governance nightmare. Husband/wife, significant self-dealing, no real business model, no assets, no real technology even. Again, I don’t know, why?

Not A Tech Company

Bad corporate governance and “controlled companies” are somewhat accepted in the tech world, because these companies have the potential for 100x payouts (because tech is a fixed cost that scales, and an asset). Investors deal with crazy founders and take that risk. But WeWork is not a tech company. At all.

For example, here are some items the prospectus lists as technology:

This is a bulletin board. You can hang a corkboard in the lobby, or setup a basic wiki if you want to ‘go global’.

This is Google Calendar.

This is Google Maps or, alternately, stepping out of a metro and walking around.

This is a printed catalog. Or you can set up an internal Shopify.

None of this makes WeWork a ‘tech’ company. It is just a company that uses technology in its operations, like everyone else. None of this creates value for investors.

Why?

Do I care about Softbank incinerating its and Saudi money? I dunno, actually yes. Weird zombie companies like this actually crowd out more sustainable companies with their predatory pricing, and we still don’t know what happens when/if they implode.

Do I care about retail investors getting bilked out of this? Also yes, in the sense that it lets Softbank and Neumann and everyone else get away with it. This whole dance is the rich subsidizing the rich to rip off the slightly less rich, crowding out sustainable innovation in the process.

This IPO is almost like a parody of past tech IPOs. Like Uber — except we buy and maintain all the cars! Like AirBnB, except we pay all the rent! It’s not even a tech IPO at all, they just have an app and seem to use computers for their work. Even the prospectus is unabashedly batshit:

We are a community company committed to maximum global impact. Our mission is to elevate the world’s consciousness.

What does that even mean? It sounds like a deadly hallucinogenic flu.

The best possible interpretation I could give to this endeavour is that it’s like Marchel Duchamp submitting a urinal in order to de-deify the artist. As in, this whole thing could be a performance piece to de-deify the modern entrepreneur. In that sense the frontispiece of the WeWork prospectus makes a bit more sense.

WE DEDICATE THIS

TO THE ENERGY OF WE —

GREATER THAN ANY OF US

BUT INSIDE ALL OF US

I guess we all do have a bit of wee inside us. And some people certainly are taking the piss.

¹ We Company Prospectus — SEC.gov