These 33 Banks Fund Climate Change

If you follow the money, these are the main sponsors of error

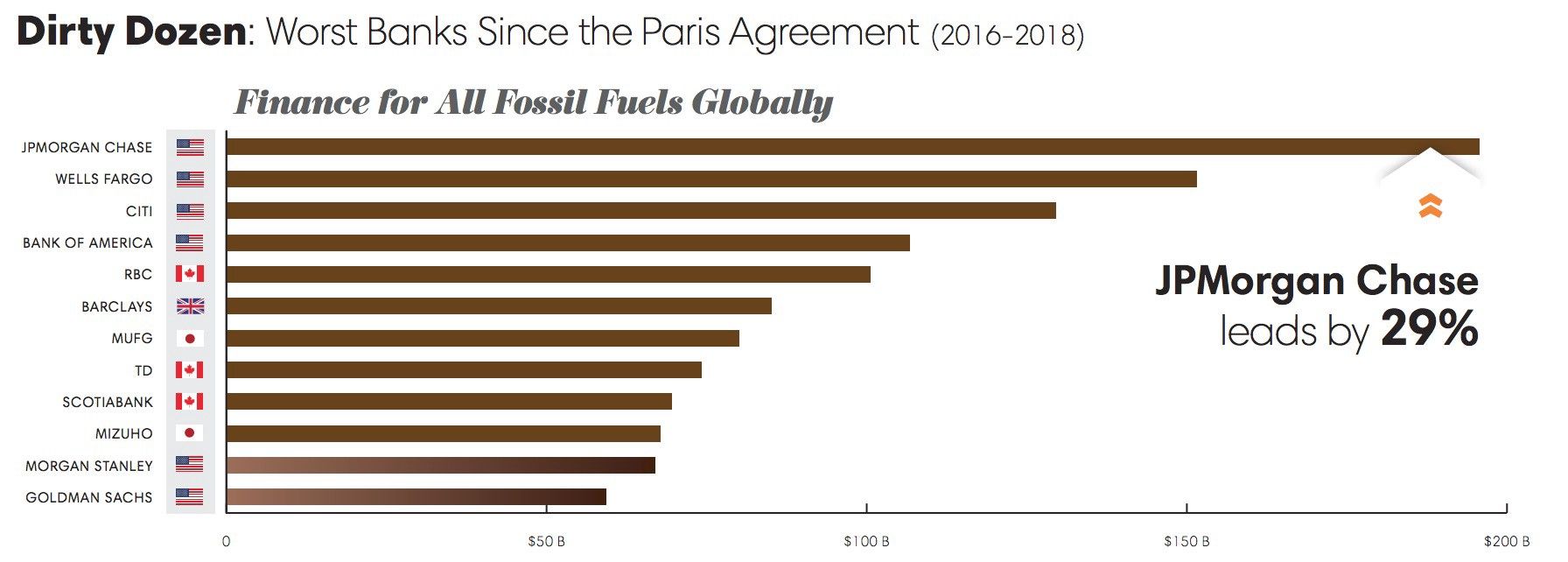

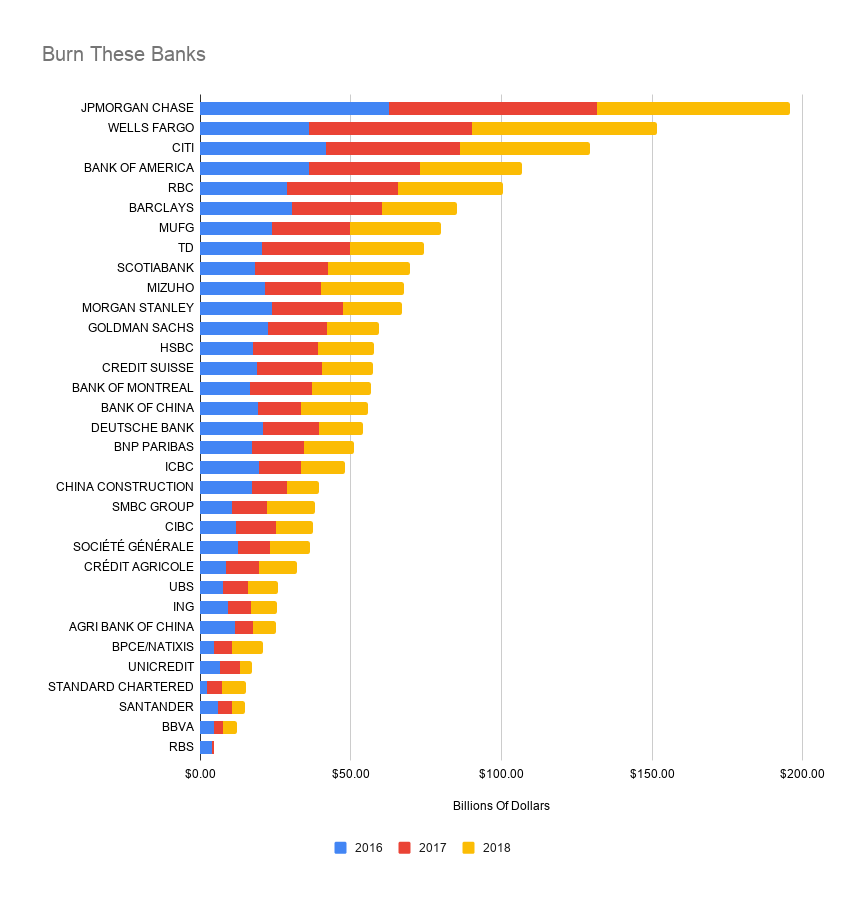

33 banks, led by JPMorgan Chase, have financed fossil fuels to the tune of $1.9 trillion since 2016. They have spent over $600 billion to expand the use of fossil fuels. The world is on fire, and they’re funding more gasoline.

JPMorgan Chase leads the chase to the bottom. They are — across the board — the world’s top financier of climate change. Now, part of this underwriting can’t just be stopped without giving the global economy a heart attack. However, it’s really about trade-offs, and pricing in risk over time.

The fact is that a $20 trillion heart-attack this decade is still preferable to the $551 trillion death that 3 degrees of warming can cause. And that is where all these investments lead. The money they are spending will cause a catastrophic rise in temperatures and untold destruction across the Earth. That’s the ROI for the rest of us.

To make it clear, we can earn $20 now but it will cost us $550 later. And banks are choosing to make this bet, perhaps because the cost falls outside of their bonus cycle, and someone else is paying the bill.

There has to be sustained pressure on these banks — ranging from protests to people calling and moving accounts — because the markets obviously are not working. These are the same banks that had to get bailed out for speculating with homes, and now they’re doing it with the entire Earth.

The Earth can catch fire in 2050 without making a blip on their spreadsheets. The only thing that can ‘price’ this in is sustained pressure from customers and citizens for banks to divest from these literally toxic assets.

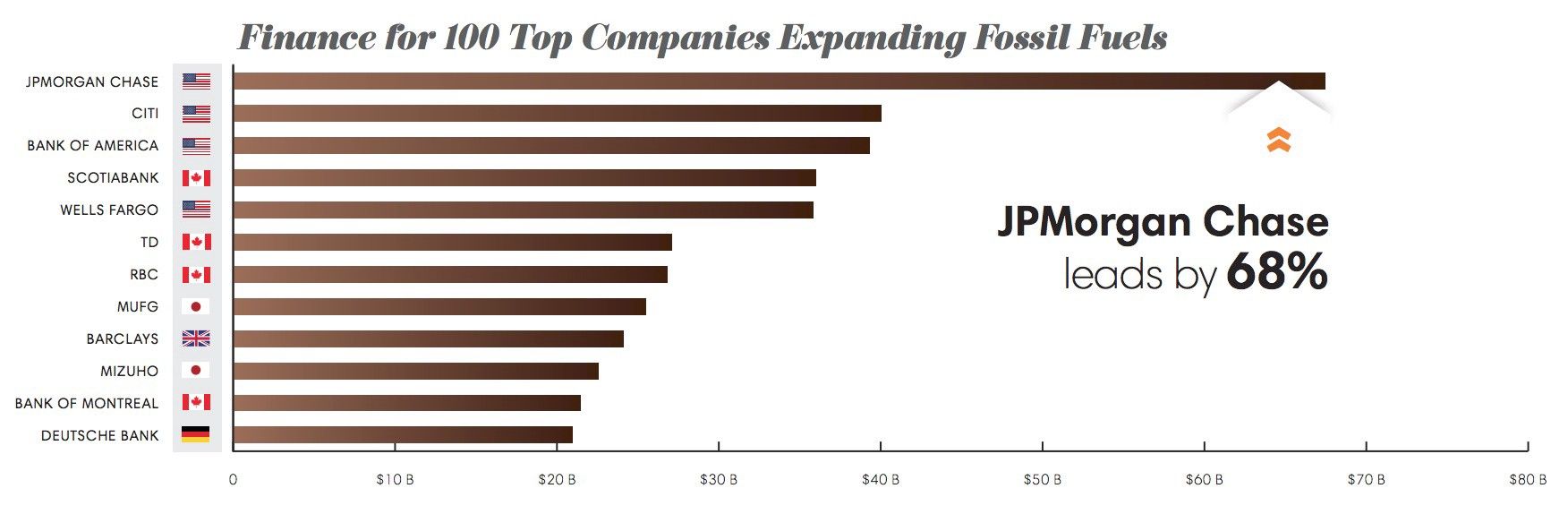

That’s a hard ask, but there is lower hanging fruit. Simply not expanding fossil fuels should be easier, but no, they’re still doing that as well. These are the banks that fund more extraction, at a time when the budget for this is zero:

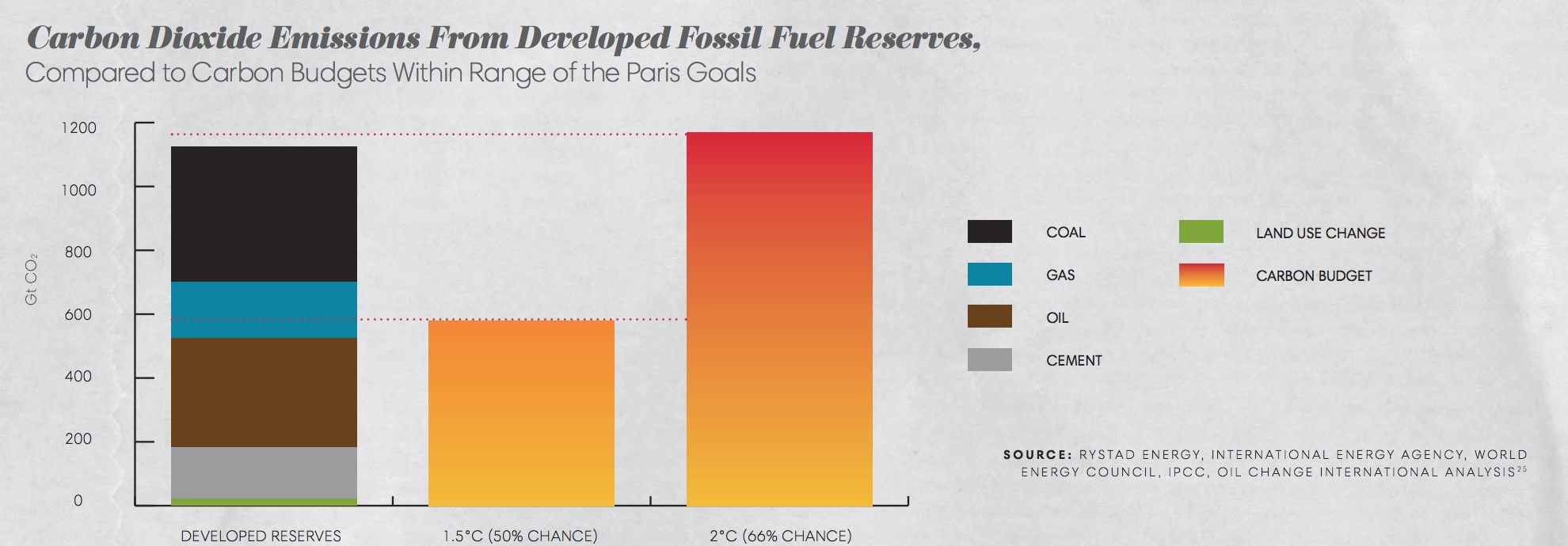

Bankers can surely understand a budget, and in this case the global budget for new carbon emissions is zero. No more. Have a look.

If we want to keep warming below 2 degrees, we have no room for any more extraction. We have to reduce the extraction we’re doing now. If we want to keep warming at a much more livable 1.5 degrees, we have to reduce usage dramatically.

None of these projections are calling for $600 billion more invested in digging up new fossil fuels, but that’s what the banks are doing.

Here’s the full list of all 33 banks:

So what can a person do? The real question is when you do something, because you’re going to get screwed regardless. It’s inconvenient now, catastrophic later.

When banks mess around it’s average people that end up getting the bill. Always. These are the same banks that taxpayers bailed out when they broke the US and global economy, and they’ll presumably get bailed out when they break the planet. Even now they issue reports and sit on panels about climate change like they’re not the biggest sponsors.

As a consumer and a citizen you can either get ahead of the curve or behind it, but it’s going to hit you either way.

Luckily there is something average people can do about this, because these are retail banks. There are 100 companies responsible for 71% of emissions, but I haven’t heard of most of them. They’re very hard to influence. These banks, however, I have heard of. I’ve had accounts with three of them before and we have an account with one of them now. As soon as we visit that country again, we’ll close it. And tell them why. There’s a lot of room for consumer pressure here. Hell, even the new Apple Card is backed by Goldman Sachs.

These banks take deposits from average people. They are susceptible to the largely symbolic act of people closing accounts, and protesting, and applying pressure. Basically, it’s your money financing climate change, so take it out. Even if you’re not a customer, it’s your lives and children that will suffer, so protest.

As Bill McKibben says, money is the oxygen on which the fire of global warming burns. If you follow the money it ends up with 100 companies and these 33 banks financing them. This is where we need to apply pressure, and we need to apply it now.

Notes:

Money Is the Oxygen on Which the Fire of Global Warming Burns — Bill McKibben, the New Yorker

Banking On Climate Change, Fossil Fuel Finance Report Card 2019 — Rainforest Action Network.

Bank | Billions (2016-2018)

---------------------------------------------

JPMORGAN CHASE $195.66

WELLS FARGO $151.60

CITI $129.49

BANK OF AMERICA $106.69

RBC $100.54

BARCLAYS $85.18

MUFG $80.04

TD $74.15

SCOTIABANK $69.57

MIZUHO $67.71

MORGAN STANLEY $66.93

GOLDMAN SACHS $59.26

HSBC $57.81

CREDIT SUISSE $57.42

BANK OF MONTREAL $56.58

BANK OF CHINA $55.50

DEUTSCHE BANK $53.94

BNP PARIBAS $50.97

ICBC $48.01

CHINA CONSTRUCTION BANK $39.53

SMBC GROUP $38.10

CIBC $37.37

SOCIÉTÉ GÉNÉRALE $36.47

CRÉDIT AGRICOLE $32.16

UBS $25.84

ING $25.55

AGRI BANK OF CHINA $25.07

BPCE/NATIXIS $20.83

UNICREDIT $17.06

STANDARD CHARTERED $15.24

SANTANDER $14.97

BBVA $12.08

RBS $4.37