The AI Bubble

Investors today are as excited as when they discovered slaves. This is, in cause if not effect, what they're doing. Discovering virtual slaves, chained to the mainframe. They're as excited as the South Sea Bubble of 1720, when real slaves were all the rage. As an old “Monument Erected In The Memory Of The Destruction Of This City By The South Sea In 1720” complained,

Thus when the sheepherds are at play,

Their flocks must surely go Astray;

The woeful cause in these Times,

(E) Honor & (D) honesty are Crimes—

That publickly are punish'd by—

(G) Self Interest and (F) Vilany;—

So much for monys magick power:

Quefs [Guess?] at the Rest you find out more.

The Slave Bubble

All the complaints about the South Sea Bubble, of course, are about the White people that lost their money, and not the Black people that lost everything. As Helen J. Paul said, “[The South Sea Company] was also a trading concern and its trade was in slaves.” The South Sea and Mississippi Companies were slavers and thieves, and the greed to get in on it made their market caps the #2 and #3 companies in history. The bet here was that colonial companies would swallow everything. And they did, just not these companies, and not immediately. The eyes are bigger than the mouth, as I say to myself at the buffet, constantly.

The Slave Bubble (née South Sea Bubble) popped in 1720 because many of the early colonial companies were simply bullshitting. Someone had a cousin in Buenos Aires and floated a company, and people bought it because other people were buying it, classic bubble behavior which met a classical ending. It was like the crypto craze of today, people selling NFTs to things that don't exist and projects that will never come to fruition. Crypto colonialism.

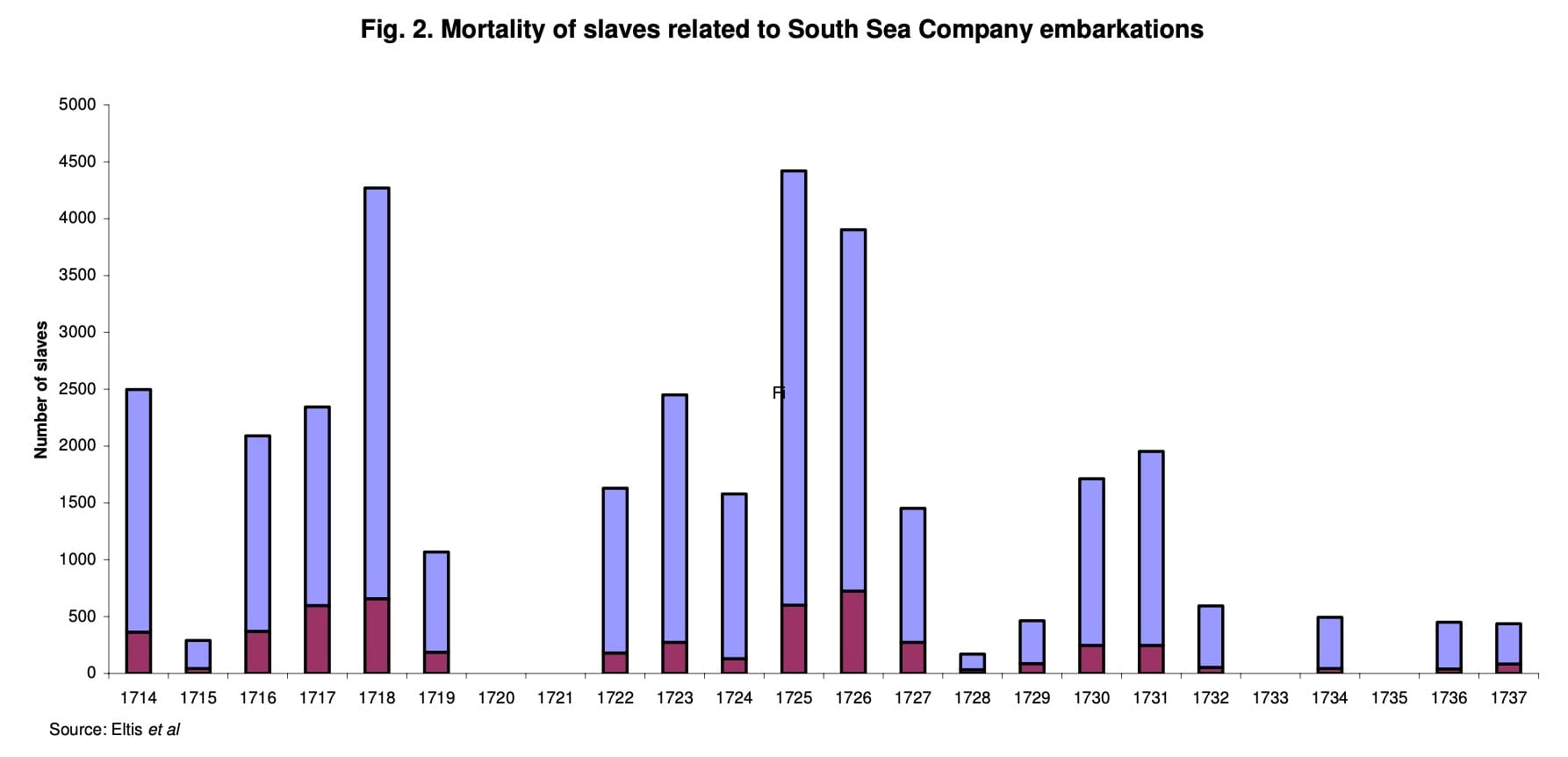

The South Sea Company was a real company, but still couldn't justify its lofty valuation, which soon became apparent. What they did have was a license to government debt, and the ancient form of debt, slavery. According to Paul, “The South Sea Company was contracted, under the terms of the Asiento [with Spain], to import 4800 piezas de Indias annually.” What is a pieza de India? According to these ignorant pieces of shit, “A pieza de India was a male slave with no defects who was at least 58 inches tall. Other slaves would be considered as less than one pieza. For instance, women were generally 0.8 of a pieza.”

This wasn't much as slaving went. From 1501-1866, it's estimated that 12.5 million Africans were enslaved, and that nearly 1.8 million were killed along the way. That's an average of 34,000 per year, with great mortality and brutality. So many souls were thrown overboard that it changed shark migration patterns. That's what the investors of the day were investing in, they were no different than the sharks really. It was a feeding frenzy, on human beings. And what was the South Sea Company doing? A drop in the bloody ocean.

Over 23 years, the South Sea Company transported about 34,000 slaves total (both before and after the pop), killing 4,000 along the way. That was table stakes for those days of plunder and profiteering. However, the table was in a casino and people were taking side bets on side bets, leading to a valuation that shook the whole British economy to its foundation when it collapsed. Europeans, who were degenerate gamblers, speculated that there was trillions to be made, and they were right, just not about who, or when, with nary a thought to why (Satan). Early investors thought they could capture all of this (literally captured) value, and early companies were quick to pretend like they could deliver almost immediately. And so the bubble inflated.

Based on the fraudulent idea that corporations owned continents and oceans, the traitor class (to the human race) called shareholders eagerly traded corporate shares amongst themselves, confident of infinite slaving in the future, or at least someone else holding the bag in the interim. They had great confidence in a confidence scheme that everyone else seemed to believe in. Who cared if the slave (and spoil) ships really came in, if the shares could be traded at a premium immediately?

Thus these early capitalists turned the world into a literal ‘Indian’ graveyard and built a casino on top. The ‘rules-based-order’ is just a Roulette wheel based on animal (including human) misery. The Slave Bubble was merely the first pop, but the AI Bubble is hopefully the last. History repeats, first as tragedy, then as farce.

The Virtual Slave Bubble

Today the stock market is peaking again, like a meth-head tweaking, on a high that won't last a weekend, historically speaking. According to Paul Kedrosky, “AI capex may be ~2% of US GDP in 2025, given a standard multiplier. This would imply an AI contribution to GDP growth of 0.7% in 2025.” I'm relying on napkin calculations via extrapolation because market data is, at this point, mutual masturbation. OpenAI just pledged $300 billion in money it doesn't have to buy infrastructure Oracle doesn't have and their shares rise because it's a bubble. Any noises you make are acceptable except pop. They're just making shit up about the future and people are eating it up because it makes money now.

It's important to note that this fraud isn't just companies like OpenAI, it's the entire corporate casino that we call the US economy. OpenAI is really just a the shell company for the Big 7 companies and the big government that are using this bubble to fill their own sails for one last round of plunder and profiteering before the whole thing goes Titanic.

When you hear about a US government trying to use AI to remain relevant it really sounds like the Spanish government of the day. The “weak core of a large empire” as Paul said, “coupled with a rigid and venal political system.” In full, to reiterate,

Slaves were the key good which might enable the British to trade with and perhaps encroach upon Spain’s American dominions. Spain itself was heavily dependent upon its American bullion shipments. Its own agricultural, manufacturing and defence industries were stagnating and it had suffered a prolonged fall in its population. This, coupled with a rigid and venal political system, meant that Spain was the weak core of a large empire. Spain was reliant on French ships, even for its bullion fleet.

The more things change, the more they stay deranged. The insane consolidation of wealth in a few monopolistic companies reflects today, don't you think? Just as the colonial companies were the economy back then, so are the cyber colonial companies today. Just look for yourself, via demonic BlackRock themselves.

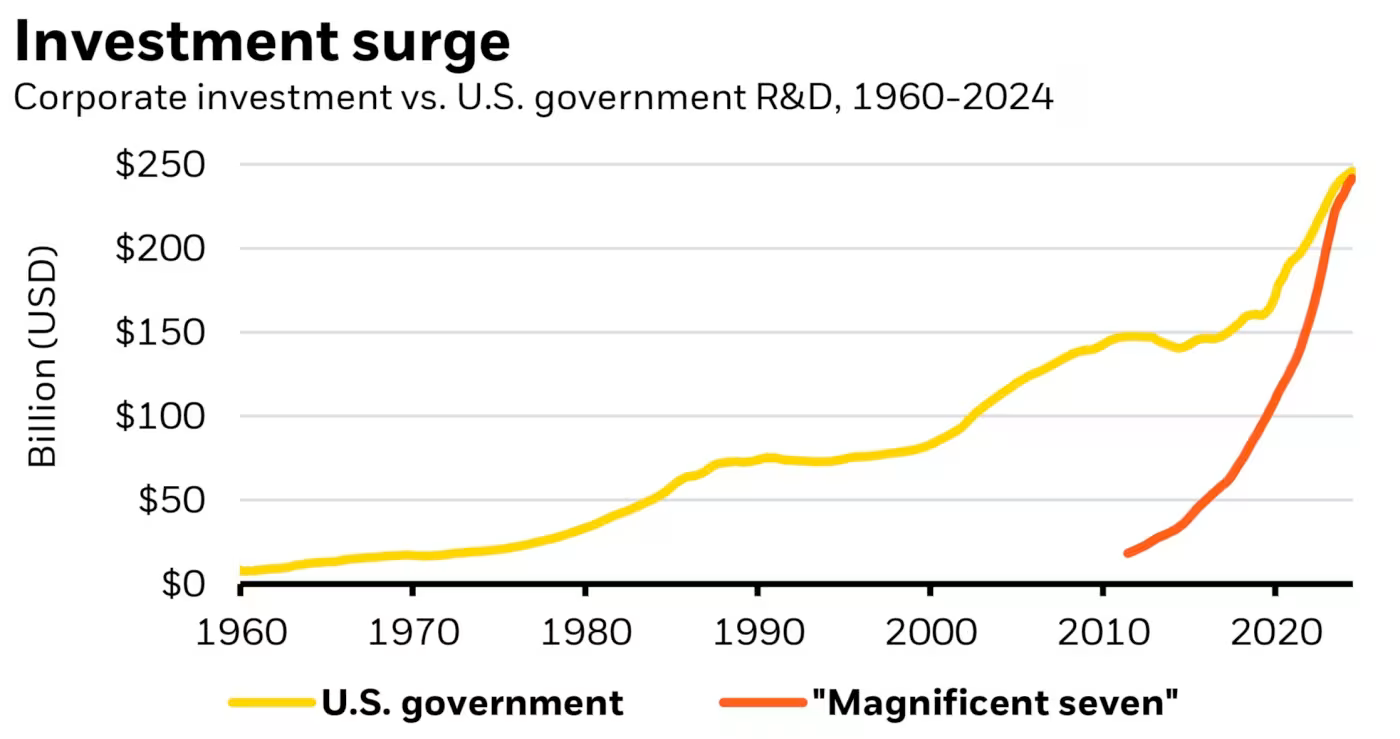

Today the US government is out-invested by just seven companies (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) all of whom are in a Satanic circle jerk with each other. A lot of value generated in this economy is just pledges passed between these few companies, and the rest is government money printing. Microsoft will buy GPUs from Nvidia, put them in racks, and sell it for stacks to OpenAI, their shell company. Then they'll rely on a corrupt media (which they don't even have to buy) to breathlessly report on successes that basic math would reveal as a lie. The US media keeps talking about the size of investment and not the fact that this investment isn't panning out for anybody. It's good money after bad, covered up with bad faith blab. And the whole cartel of kakistocracy has to be protected by the US government from better foreign competition, ie cheaper chips and more efficient algorithms like DeepSeek. America is practicing state crapitalism and it stinks.

American companies have, since at least Uber, abandoned Generally Accepted Accounting Practices (GAAP), American media has abandoned the general concept of accountability or even just counting, and they run whatever made-up numbers these companies make up. For example, as Ed Zitron cites, “OpenAI leaked on July 30 2025 that it was at $12 billion annualized revenue — so around $833 million in a 30-day period — yet two days later on August 1 2025 the New York Times reported they were at $13 billion annualized revenue, or $1.08 billion of monthly revenue.” This concept of ‘annualized revenue’ is GUAPA, Generally Unaccepted Accounting Practice, Asshole. They're just picking whatever 30-day slice makes them look good, multiplying it by 12, and giving differing numbers depending on what day you talk to them. And the numbers don't even look that good!

Like the South Sea Company, OpenAI is just doing table stakes in the tech casino, but the buzz around them is used to inflate the whole operation. How is a company with a merely alleged $12 billion in annual revenue (not profit!) committing to $300 billion in future contracts with Oracle? It's only because the whole US economy is a bubble, and they're all in it. The US statistics department just revised jobs numbers nearly 1 million down after investors had already cashed in on the false ones, and they're doing this regularly now. And Trump just fired a government statistician because she wasn't making up numbers in his favor. The whole US government is run by a failed casino operator (how?) overseen by a Congress of insider traders. It's wheeler-dealers within wheeler-dealers, douchebag ex machina.

If you take speculative AI spending out of the US economy, congratulations, you've gutted the American economy. The US economy today is basically just a multilevel marketing scheme. As Kedrosky says in Honey, AI Capex is Eating the Economy,

One of the abiding mysteries of the current political era is why the economy is, for the most part, not as worried as one might expect about tariffs, political uncertainty, capricious office-renovation-driven-Fed-chair rumored removals. We now have a possible answer. In a sense, there is a massive private sector stimulus program underway in the U.S.. There is an AI datacenter spending program, one that is reallocating gobs of spending, as well as injecting even more. It is already larger than peak telecom spending (as a percentage of GDP) during the dot-com era, and within shouting distance of peak 19th century railroad infrastructure spending.

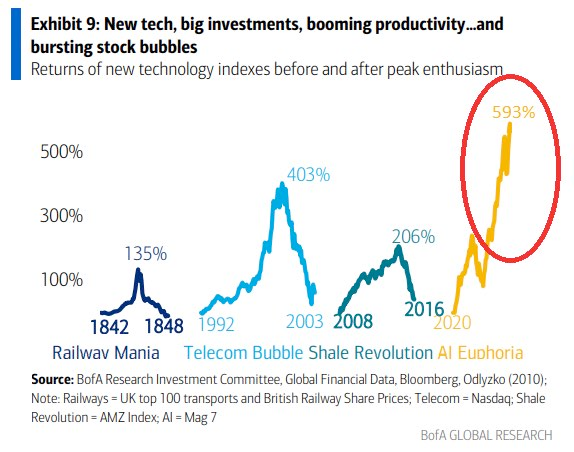

As Bank of America Global Research shows, this certainly looks like past bubbles (they leave the slave one out).

The big difference is that slaves, railways, telecom infrastructure, and shale oil at least had some physical value. Even after the 1720 crash, the South Sea Company kept slaving, America kept railing, and telecom kept dot-com'ing. AI, however, cannot persist for an instant without massive amounts of energy (re: cash) thrown at it. These companies aren't even profitable on a gross profit level (an archaic economic term when you can just make up ones that look better). AI is just speculation atop speculation, people guessing that a guessing machine is going to make money some day, despite over 4 years of not doing it. What is under this boom, really? It's the idea of virtual slaves that will replace many if not most workers, but that's not happening, innit? Whereas actually slavery was profitable, however, virtual slavery decidedly is not.

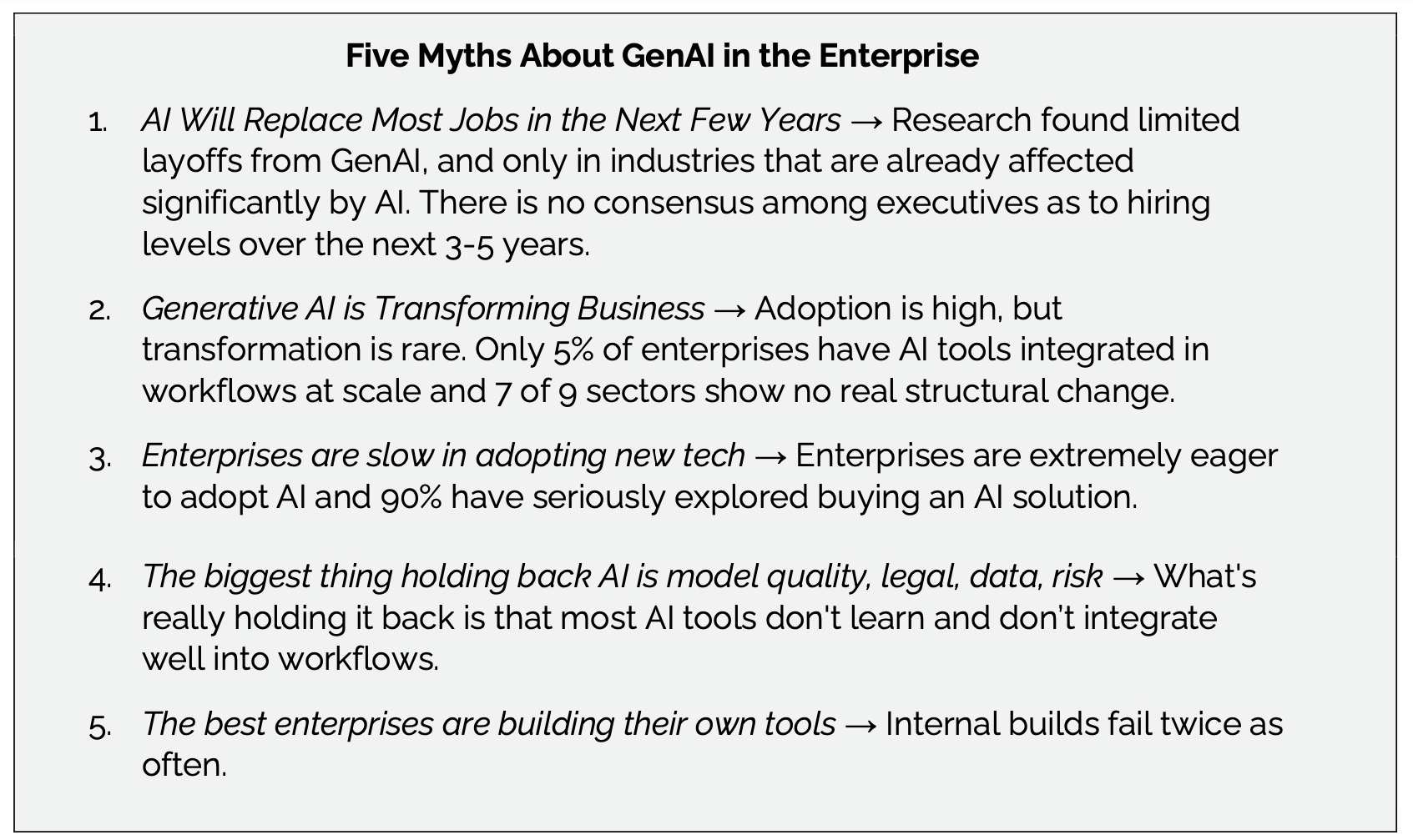

As a recent (2025) MIT report said, “Despite $30–40 billion in enterprise investment into GenAI, this report uncovers a surprising result in that 95% of organizations are getting zero return… Just 5% of integrated AI pilots are extracting millions in value, while the vast majority remain stuck with no measurable P&L impact.” The stock market is pricing in trillions of future returns across entire industries, but what we have is a fraction of companies making millions after investing billions. This is about as substantive as the skin on a bubble.

As Jim Covello of Goldman Sachs (deep in the butt crack of capitalism) said in 2024, “What $1tn problem will AI solve? Replacing low-wage jobs with tremendously costly technology is basically the polar opposite of the prior technology transitions I’ve witnessed in my thirty years of closely following the tech industry.” Covello asked this roughly two years into the AI boom (if we date it from ChatGPT 3.5) and there were no profitable companies then. And there still aren't now, two more years along. The only people making money (NVIDIA, Oracle) are selling shovels to speculators, and the hucksters shovelling this shit to dumb investors. It's a gold rush with fool's gold. And yet you're almost a fool to not be in on it.

The funny thing is both Covello and MIT are still ultimately bullish on AI because they're still, fundamentally, members of the herd. Covello spends a whole interview saying, “Over-building things the world doesn’t have use for, or is not ready for, typically ends badly,” but then says, “That said, one of the most important lessons I've learned over the past three decades is that bubbles can take a long time to burst. That’s why I recommend remaining invested in AI infrastructure providers.” This is dumb, but that said, let's do it.

As Karl Marx, who called everything, said,

Capital, which has such ‘good reasons’ for denying the sufferings of the legions of workers surrounding it, allows its actual movement to be determined as much and as little by the sight of the coming degradation and final depopulation of the human race, as by the probable fall of the earth into the sun. In every stock-jobbing swindle everyone knows that some time or other the crash must come, but everyone hopes that it may fall on the head of his neighbour, after he himself has caught the shower of gold and placed it in secure hands. Après moi le déluge! is the watchword of every capitalist and of every capitalist nation.

The fact is that every stage, capitalism must have something to capitalize upon. That's the only way the artificial beast lurches on, from crash to crash, calamity to cataclysm, con to con. Hence you get the various bubbles, the Slave Bubble of moving labor and resources across the water, the rail bubble of doing the same across land, the telecom bubble of moving (effectively) through the air, and now this AI bubble, which is supposed to expand into some virtual realm. But as the name implies, this isn't real.

Virtual slaves are simply not that useful, and certainly not profitable. Whereas slaves were immediately used for mining and growing precious resources, virtual slaves are used for vaporous bullshit. As the MIT report says, “only two industries (Tech and Media) show clear signs of structural disruption,” but these are bullshit industries where a bullshit generator makes sense. But in the real world, AI simply isn't that big a deal and isn't cost-effective to apply everywhere. You can see this in China, which is investing in AI, but not building its whole economy around it. On the other hand, in America, most VC funding is now going to AI while their physical infrastructure and basic manufacturing is crumbling. Rather than building pyramids, they're just pyramid scheming.

The Everything Bubble

The essence of a pyramid scheme is paying off old investors with new schemes, and this is precisely what White Empire (Spain, Britain, America, same colonialism) has been doing since the beginning. AI is just the last scheme, a last furious incineration of the environment before the environment collapses atop them. The foundation of their pyramid was a tragedy—human, animal, and environmental slavery—but the capstone is a farce—virtual slavery which doesn't even work. What jerks.

Like Scarface trying to shoot his way out of a home invasion using wholesale amounts of cocaine, America is trying to scoot its way out of a depression with colossal mainframes. In both cases, the approach is scatterbrained. They are confusing getting high with moving forward, and these are not the same thing at all.

When this bubble finally collapses it will be an everything bubble, because the White Empire hasn't been investing in anything else, its people are indebted, and its country has a worse debt-to-GDP ratio than Sri Lanka. The only reason they haven't crashed is because of the exorbitant privilege of being a reserve currency, but they're obliterating this by being exorbitant assholes to everybody via tariffs and sanctions. The fact is that the White Empire has always been in debt, and always been pushing the debt forward, including the hideous judgement they can expect from Allah.

Ever since they started, they've been leveraged to the hilt, and always had to find a new continent, a new population, a new energy source, a new stock to exploit. There always had to be something new and potentially infinite to hold all of the compounded hopes and schemes they've been carrying forward since the 16th century at least. As Matthew McConaughey said in Wolf Of Wall Street, explaining the whole carnivorous history, coincidentally,

You have a client who bought stock at 8 and later announced it's at 16 and he's all happy he wants to cash in, liquidate, take his book, take his money and run home. You don't let him do that, okay, 'cause that would make it real, right? No. What do you do? You get another brilliant idea, a special idea, another situation, another stock to reinvest his earnings and entice him, and he will, every single time, 'cause they're addicted. You just keep doing this again and again and again. Meanwhile, he thinks he's getting rich (which he is, on paper), but you and me, the brokers, we're taking home cold hard cash via commission.

To repeat Marx, who bears repeating, “In every stock-jobbing swindle everyone knows that some time or other the crash must come, but everyone hopes that it may fall on the head of his neighbour, after he himself has caught the shower of gold and placed it in secure hands. Après moi le déluge! is the watchword of every capitalist and of every capitalist nation.”

After AI, the deluge. I, for one, look forward to it. The Empire that lost all moral authority in the Al Aqsa Flood, will lose all economic power in the delulu-deluge.