Tesla’s Netflix Problem

Tesla is about to run into the same problem that Netflix is running into. Competition.

Netflix

When Netflix started producing instead of just distributing content, it was a big risk, but it seemed to pay off. After they first produced House Of Cards in 2013, subscriber growth took off.

Producing content was a risk because this pissed their suppliers off. Netflix went from a place that distributed content for studios to another studio that competed with them. Shots fired.

Now the empires have struck back. Disney and ViacomCBS are pulling content and moving it to their own streaming services (Disney+ and Paramount+). Warner Bros Discovery is removing Friends (Netflix’s most popular show) and moving it to HBO Max. Places like HBO never fucked with Netflix in the first place, and Apple and Amazon Prime are streaming too.

Netflix now faces a war on multiple fronts. You could say that Netflix had to fire the first shots, but now they’re in a war with their former suppliers, old competitors, and new competitors as well. And it’s taken a toll.

Netflix subscriber growth has stalled out and is now in decline. This quarter they reported losing 200,000 subscribers, which is nothing to sneeze at. In truth, they lost 700,000 from the West’s collective punishment of Russian people, meaning the quarter would actually be a 500,000 gain. But those accounts are still gone, and the playing field has changed.

Netflix blames password sharing, but that’s presuming a world where Netflix was still the only streaming option and they’re not. Customers have many streaming options and only so much money. Indeed, Netflix’s innovation of binge-watching may now be causing problems. If you get into a show you need to keep your HBO Max subscription to watch the next episode. On Netflix, you can binge and depart.

Whatever the manifestation, the overall problem Netflix is facing is competition. While there’s still plenty of room for a sustainable business, tech investors like monopolies. They don’t like that competition shit at all, which is why Netflix’s share price is falling. Now let’s explore why Tesla has the same problem incoming, and is even more exposed.

Tesla

After their recent haircut, Netflix's Price-to-Earnings ratio is 17x. Tesla’s is a staggering 118x. While investors are expecting Netflix to perform a difficult 17x better in the future, they are expecting Tesla to perform an impossible 100x better. The company just can’t. In the medium term, the stock can still go up as long as people believe in greater fools, but at some point reality will kick in and you’ll be the dumb one.

The problem is not anything internal to Tesla, it’s just competition.

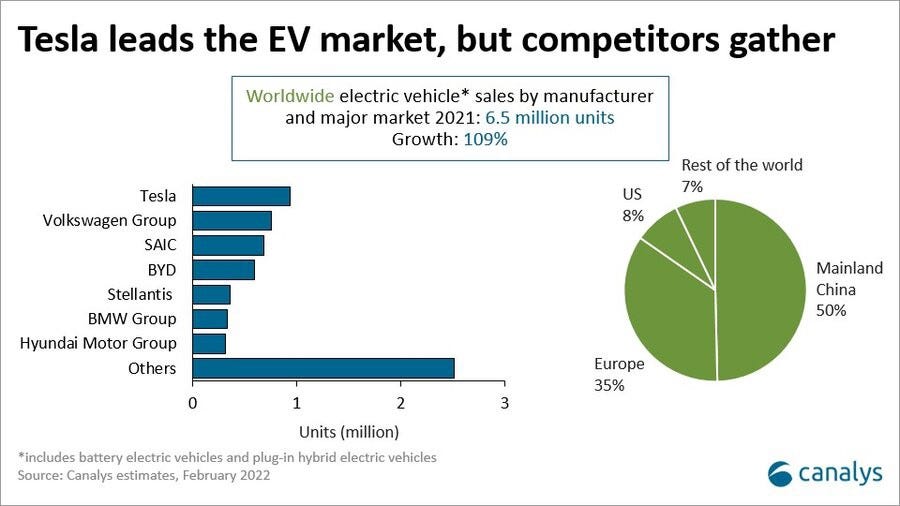

Right now Tesla is leading the world in sales, but competitors are rapidly gathering steam, or in this case lithium. The Volkswagen Group is pushing out electric cars (including from Audi and Porsche, hitting Tesla’s luxury segment, especially in Europe), Ford and GE are pushing out the trucks that move in America, and China is already the biggest EV market with its own brands.

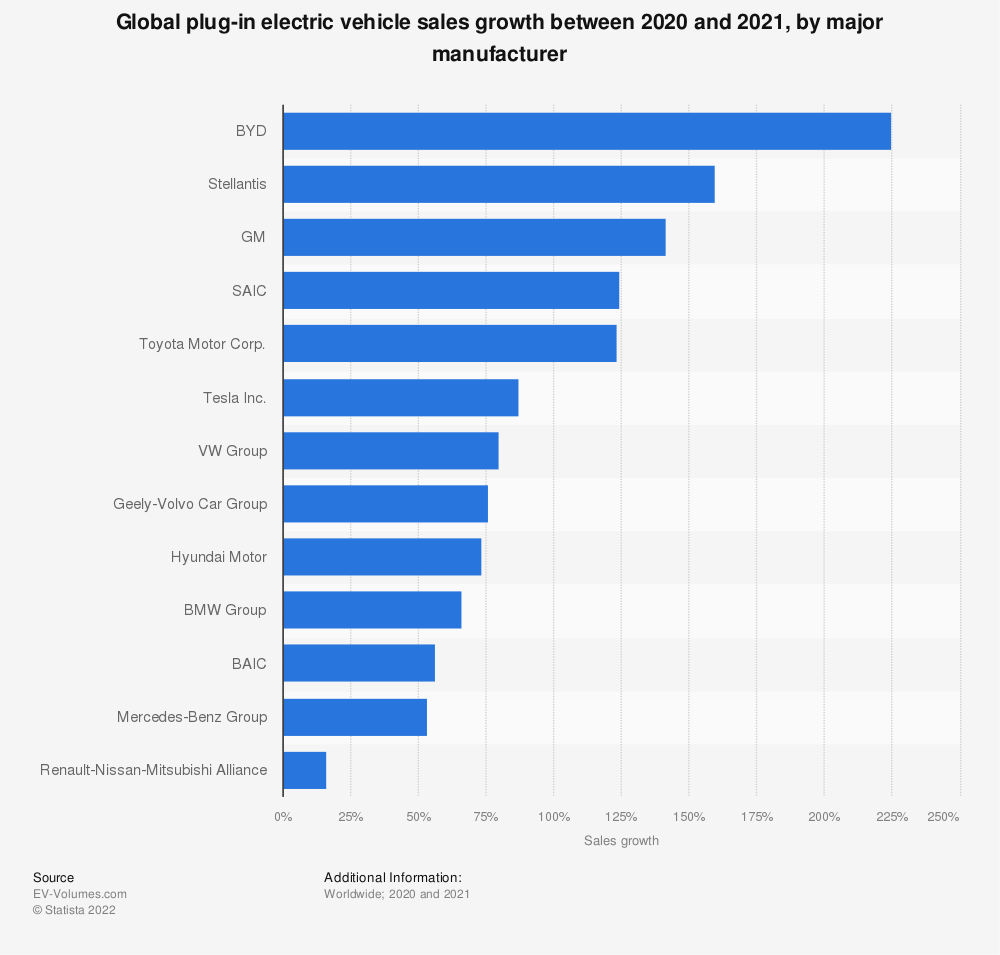

In terms of growth rate, Tesla is already fucked.

BYD is a Chinese manufacturer which has huge domestic demand and SAIC already owns ‘western’ brands like MG which are already selling EVs in foreign markets. Stellantis (Fiat, Chrysler, Dodge, Jeep) is a European sleeper, and GM is an American giant. And now Toyota is finally entering the EV chat, after lingering too long on hybrids.

These are all big players that—while they can’t turn on a dime like Tesla—are as powerful as a freight train once they get going. And there’s a lot of them. This both drives up costs for raw materials (like rare earth minerals), it simply results in consumers buying other products.

The problem Tesla faces is not any single competitor, or their own competitive position, it’s competition in general. There is no significant lock-in on cars, indeed the whole destructive business is based on replacing them frequently. You could say maybe charging stations, but that’s a solvable problem with a lot of money going into it. That moat won’t hold for long.

Like with Netflix the problem isn’t that Tesla can’t be a sustainable business, it certainly can. It just can’t deliver 100x growth. There’s simply too much competition.

Competition

The conventional macroeconomic logic of competition is that it drives prices down to the subsistence level for corporations. In practice, it never quite works like that, and cars especially are many different markets (luxury, work, family) rolled into one. The problem both Tesla and Netflix faced is that they raised money on the premise of taking a chunk of the whole market, and that’s just not going to happen.

Both streaming and electric cars were too big to be left to one company each for long. There are no natural monopolies in either, and so you get competition. This is normal for most companies, but when you’re trading at 17–118x earnings, you’re pretty fucked. So the haircut is happening to Netflix, and with Tesla, it’s just a matter of time.