Raising Interest Rates Is Just The Rich Stealing From The Poor

In the future, insomuch as we have one, people will look back on raising interests like we look at blood-letting. Doesn’t work, makes things, worse, and shows no understanding of the complexity of the systems involved. I won’t get into the abstract theology and unproven assumptions of mainstream economics. I’ll just talk about the impact of raising interest rates on the real economy.

What Are Interest Rates?

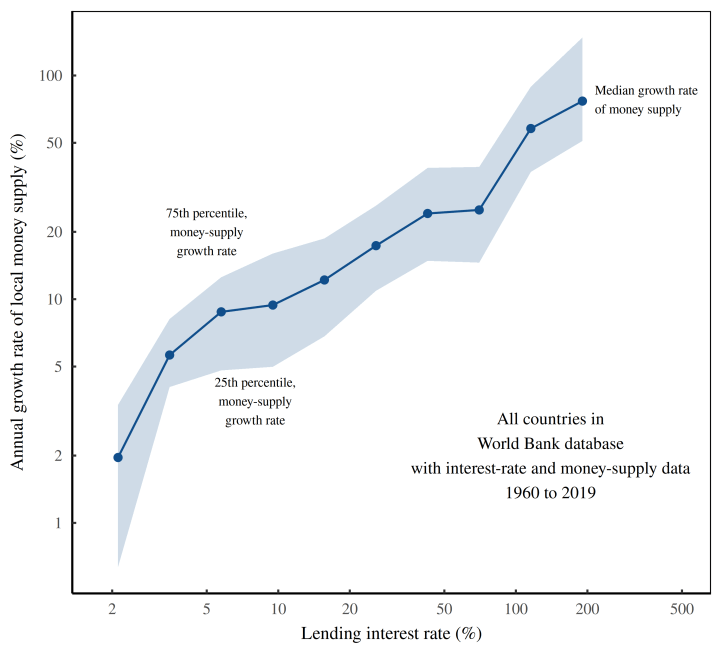

Interest rates are just the rate of private taxation. The government gives money to the rich (banks, primary dealers) and allows them a certain rate of usury. Interest rates are just the amount the rich are allowed to tax the poor. I say tax because it’s all charges for nothing. Credit card interest rates to just pay your bills, rates on home loans to live, rates on education loans to even participate in the economy, all things that should be publicly supported are instead privately taxed. Rich people are given assets through privatization and monopolization and are then allowed to tax the poor mercilessly. All they have to do is give ‘donations’ and ‘speaking fees’ and director’s seats to ostensibly democratic governments and the whole fraud is openly bought and paid for. I’ll repeat, interest rates are just the private tax rate. It’s what the oligarchs that actually run the place are allowed to tax the poor.

I know this because I am rich and, unlike most people, I have savings and investments. As the economy in my country (Sri Lanka) crashed I started receiving interest rates nearing 30% while poor people lost meals, kids stopped going to school, and small businesses collapsed under the burden. The blunt, blood-letting instrument of raising interest rates just collapses complex real-world problems (predatory western debt, lack of energy generation, lack of industrialization) into the dim idea of giving rich people more money. The rich people will surely figure out. Except we fucking don’t. We just sit around collecting interest and bleeding the country dry.

What Does Raising Interest Rates Actually Do?

Most economists have never run firms and don’t actually measure or test any of their assumptions. Raising interest rates doesn’t actually reduce inflation, it increases it. Raising interest rates is just trickle down economic and it doesn’t work. It’s just the rich pissing on the poor and calling it rain.

Now you could say the other factors in the world (war, oil prices) are what cause prices to keep rising, which shows the futility of correlating all human activity with one number (like an interest rate). But if you are going to die on the hill, economists should be dead. Raising interest rates simply doesn’t reduce inflation and, like blood letting, makes the patient worse.

As people like Blair Fix and Tim Di Muzio (linked below) laboriously document since most firms practice cost-plus accounting and simply pass higher borrowing costs onto consumers. As Di Muzio goes into in detail:

My research suggests that in the short run, raising interest rates could actually make inflation worse, as business cost increases from rate hikes get passed to consumers. But in the medium to long term, when businesses can no longer raise their prices further with any success, they might simply shut down production and lay people off; which will mean fewer consumers with money in their pockets, and so fewer profits for firms; which will lead to yet more firms shutting down, etc — the familiar deflationary spiral of a traditional recession. The good news, if you can call it that, is that when firms see a depression coming they tend to lower prices. The bad news is that you’re now in a recession, with all the mass unemployment and shuttered workplaces and lack of investment that implies. Thus, the Fed will have succeeded in lowering prices, by annihilating the economy. It will have fixed a stubbed toe, by amputating the foot. And what’s worse, given the deep roots of the present inflation in supply chain issues, there’s no guarantee a recession would even lower key prices at all. An interest rate hike is a non-solution at best, and fuel to the fire at worst.

What I will tell you is simply how this operates at a firm level, where it is obvious to anyone actually dealing with an economy and not abstract ‘economics’. I’m on the board of a public company (consumer foods) and when interest rates rose our borrowing costs went way up. The company dipped into a loss-making quarter for the first time in the six or so years I’ve been there. To cover that up the management raised prices, as they have been for over a year now. So the company stays afloat, but at much lower volumes. As you can see, higher interest rates translate directly into higher prices. Anybody remotely involed with running a company can tell you this. Higher interest rates also destroy small and medium sized firms and favor the big and already wealthy. Leading to further concentration of wealth. As I said, stealing from the poor to give to the rich.

Now remember that this is a consumer food company. If our volume reduces that means people are eating less protein. They are not getting the nutrients they need to sustain their bodies. Insomuch as inflation reduces, it is because people cannot buy goods at all. Raising interest rates leads to massive demand destruction, which is just a fancy way of saying people go without and starve.

This is like drawing someone’s blood and saying look, they don’t need oxygen anymore, it worked. It didn’t fucking work. The patient is dead and only the leeches are doing well. It’s a farce. In Sri Lanka, 90% of households can’t guarantee nutritious food for their children, while asset owners are earning 30% doing nothing. And we’re told this is necessary, that this is the only way to ‘fix’ the economy. It’s just the same people that wrecked the economy helping themselves even more.

Stealing From The Poor

Again if we go back to the point that interest rates are just the private tax rate given to money-lenders by the politicians and the institutions they have corrupted, it makes more sense. When things get hard, the rich think about themselves and ensure that their money-lending profits not only go untouched but actually increase. They then stash this money rather than investing it because why would they? They can get good rates from plain old usury rather than any other productive activity.

What would a better response be? The Great Depression era idea of public works, government jobs, and massive spending projects and services that go directly to poor people, who actually are the economy, not the leeches on top. A dollar given to a poor person is immediately spent and multiplies 10 times across the community. Meanwhile a dollar given to a rich man ends up in the Cayman Islands and does nothing for anyone. It used to be economic wisdom that you need to spend your way out of depressions, but now the old economic religion of ‘steal from the poor, give to the rich’ has taken sway again, all over the world. From austerity and rate hikes in the White Empire, from the center America on out, to IMF-imposed deprivation and starvation over the south, including my country Sri Lanka. All of them are applying monetary theory as avidly as medieval hacks applied leeches, with no understanding of what’s really going on.

What is happening all over the world are real problems. Real war, real sickness, real lack of industrialization/productive work, real climate collapse. Simply changing the rate money-lenders bleed the poor doesn’t do anything about any of these problems, it just bleeds the poor. Governments can’t just give money to the rich on the magical belief that they will solve our problems. They fucking won’t and don’t, they are the problem more than anything else. Government programs, ie democratic programs need to directly address these problems by A) not starting or joining wars B) growing food C) producing ‘better’ energy sources D) directly creating jobs and E) directly pulling people out of poverty. That is how you overcome problems, by looking at them directly and fixing them, not changing some number and expecting an invisible hand to do it all.

Raising interest rates is fucking medieval. It’s just stealing from poor to feed the already engorged rich. God knows we need a Robin Hood about now.

Further Reading: