One Actual Use Case For Crypto

Besides speculation, the one use case I’ve found for crypto is that it lets you move money between currencies. It’s a black market hawala system for white people. This is pointless for most currencies, but it suddenly becomes very useful if your currency goes off the rails.

And my currency has gone off the rails. So this is suddenly one useful aspect of crypto.

The Sri Lankan Rupee has depreciated by over 60% in less than two months, becoming more unstable than crypto. It’s certainly more unstable than ‘stable’ coins like USDT, pegged to the US dollar. In this uniquely volatile environment, crypto suddenly becomes a useful medium of exchange.

I say this crypto hawala system is useless in most countries because why would you? Just use the bank or Transfer Wise, it’s much easier. In my country, however, this doesn’t work. Forex has dropped so low that we’re not allowed to move much money out. So we have no choice, it’s either hawala or crypto hawala.

This is possible without cratering the exchange rate because in both cases, money doesn’t actually move across borders. Both methods are “money transfer without money movement.”

Let me explain the methods, one by one.

Crypto Hawala

In crypto hawala (like Binance P2P) you start by putting money in a random stranger's bank account. It sounds crazy, but hear me out. When you do that, Binance freezes some crypto in that guy’s account. Now it’s neither yours nor his, it’s held in escrow.

When that guy confirms that he received the money, the crypto is automatically released to you. If he doesn’t then it goes into a customer service appeal, which in my experience resolves in a week at most. You get the black market rate on rupees, so you lose like 15%, but it works. The money comes through.

Now your rupees have turned into USDT, and you can reverse the process to turn that into pounds or whatever you want. And it works quite well, even when it goes wrong. If someone never transfers the money (or the crypto) it goes into appeal, and the escrow holder (Binance) gets bank screenshots and sorts it out.

This is pretty cool because you’re moving money without moving money. It all passes through this crypto realm which doesn’t affect exchange rates, at least not at these amounts. All the rupees stay in Sri Lanka and all the pounds stay in the UK. The only thing that really moves is crypto, which lives nowhere at all. It’s a cool system, but it’s not like they’re the first ones to figure this out.

Hawala Hawala

People have been moving money for hundreds of years without moving money (and without also burning down the rainforest). It’s called the hawala system, and it’s still quite active, especially in Asia.

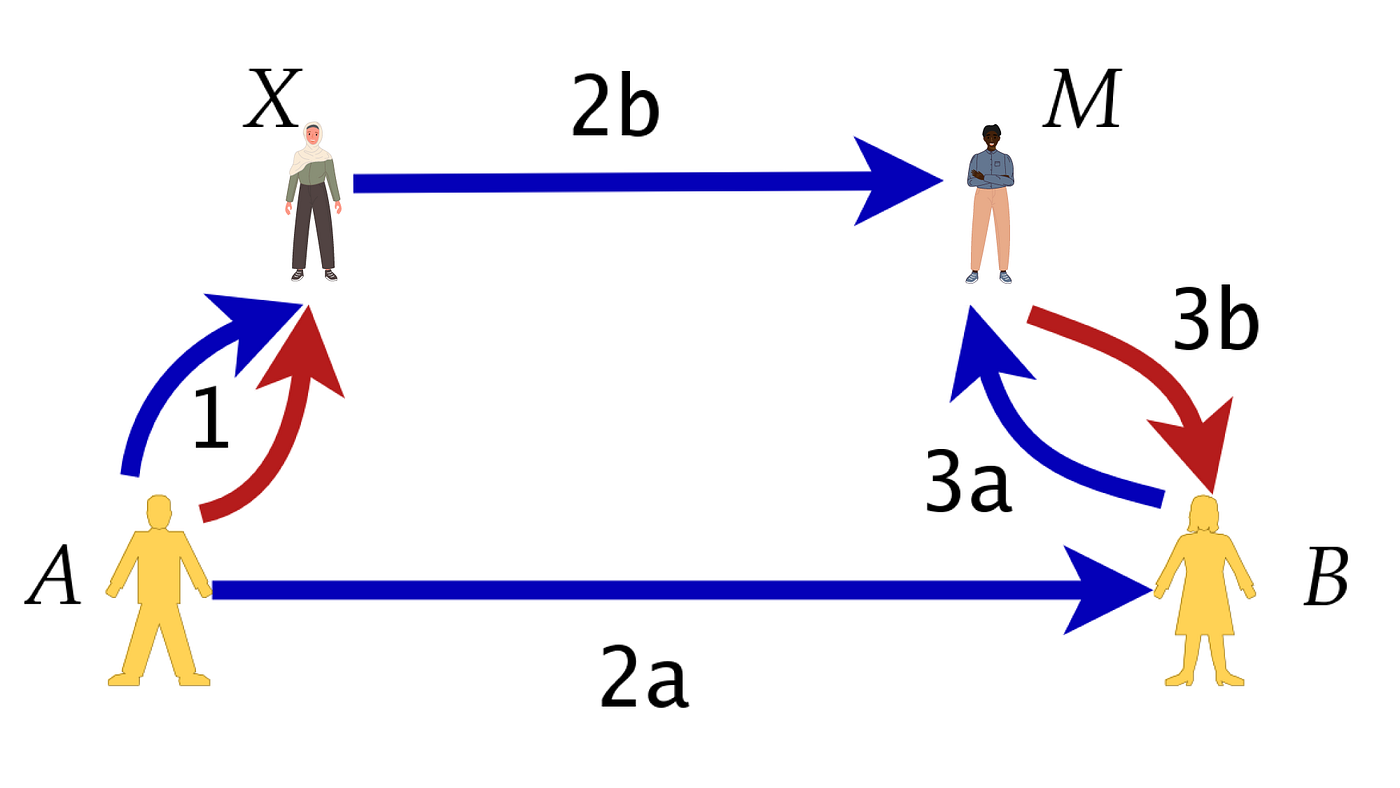

How the hawala system works is illustrated above.

You give a hawaladar rupees and a password, and then someone with the password withdraws pounds from another hawaladar. No money actually moves across borders. The hawaladars keep their own accounts, based not on contracts but honor and reputation. They might settle up in cash, or kind, or whatever.

The hawala system operates completely outside ordinary financial and legal systems and can work even in the absence of functioning government. This of course makes it a threat to governments and it’s prone to persecution and getting shut down.

Once a relative moved some money through a hawaladar and got his bank accounts frozen, it sucked. And yet for millions of transactions every day, the hawala system usually works, and with no energy use. Just human trust.

Crypto Hawala

All tech bros have really done is replicate the hawala system at much higher cost. Instead of human trust, crypto exchanges are bound by compute cycles, which scorch the Earth. Indeed, many of the people on the crypto exchanges arehawaladars, making the crypto part kinda redundant.

As you can see, I’m generally opposed to crypto (though I see its existence as being as inevitable as the malevolent corporate form). I’ve written against it before. So why does it make sense now?

Well, like I tell my wife, we’re in an ‘eat the dog’ situation. Most days you’re not going to eat the dog, but someday you may need to eat the dog. And this is one of those days when we need to eat the dog (sorry Lilly). For Sri Lankans that need to move money, there aren’t many options. And as global financial collapse spreads, this use-case will spread across the world.

Hence you may see more and more people go to either the regular or the crypto hawala. This is one actual use-case for crypto, something that’s not pure speculation but which is connected to actual human use-values. Not as a store of value, but just a way to move value around.

Yet I pray that this use-case never has to be used by you. Because—besides being dodgy and wasteful—going to the crypto hawala means shit has really hit the fan.