Netflix’s Secret Weapon: The World

Over 50% of Netflix’s business is now international

We’ve seen shots fired in the streaming wars, but it is not yet World War TV. If you live outside of America, nothing much has changed at all. It’s still mostly Netflix because the other streaming services won’t take our money. And it is a lot of money.

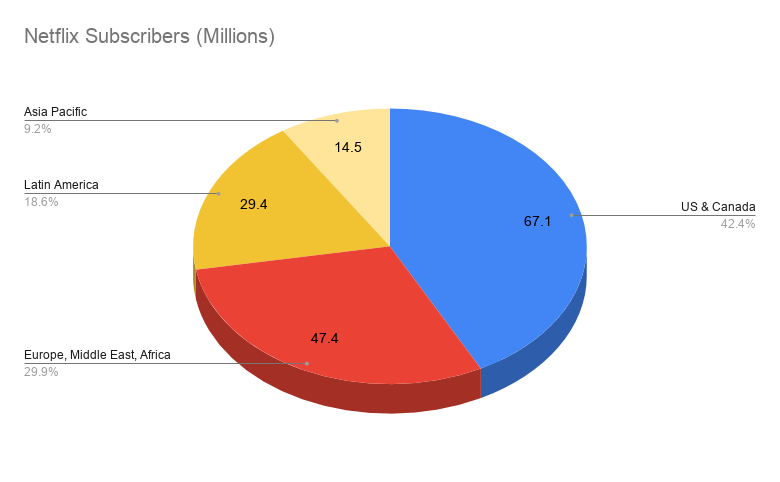

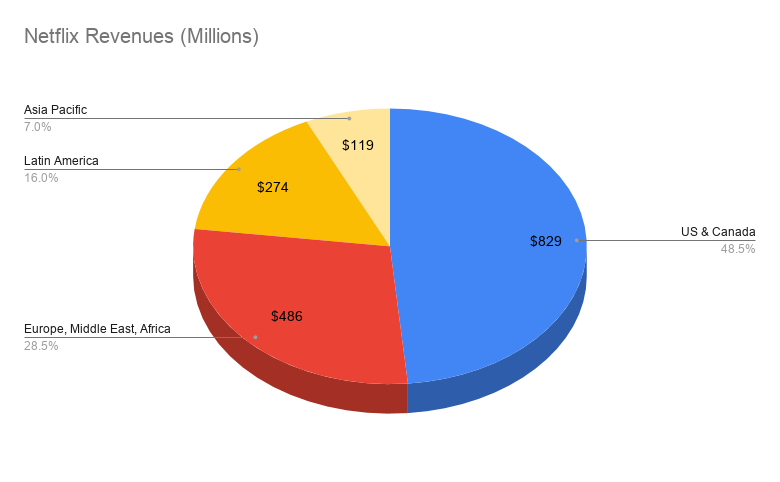

You can see this in Netflix’s latest numbers.

Today, the majority of Netflix’s subscribers come from outside of the US and Canada. It’s also a majority of their cash.

Each month, Netflix earns $879 million from ‘the rest of the world’ and $829 million from the US and Canada.

While most of the press depicts the streaming wars as a head-to-head fight between Netflix, HBO, Disney, etc, it’s actually just a local battle. For now.

The Global Players

The only players agile enough to serve almost all potential customers are the digital natives — Netflix, Amazon, and Apple. These guys own enough of their content and thought far enough ahead that they can offer a functional library everywhere from Milwaukee to Mozambique.

This is only possible because they invested heavily in tentpole shows (Stranger Things, The Morning Show) that can drive 80% of user demand while they figure out the licensing on the rest of their content. Netflix and Amazon have been doing this for years, so they have a decent library to show users. Apple just has a tiny library and doesn’t care.

As an aside, Apple could have really owned the whole market if they created their own TV. Like they did with the iPod and iTunes, they could have controlled video streaming from hardware to content. However, Steve Jobs died and this never happened. In today’s market, Apple is just another player, and a distant third or fourth at that.

Ahem

Before we move on, one question worth asking is whether this is a global business at all. Uber thought cabs/food was scalable, and now they are in retreat across the globe. Some businesses are actually stupid to scale and best left to local players.

The gold standard is whether you can spread the same fixed costs across more users. That’s a scalable business. For example, Google can serve its 1,000,001st user for the same cost as their millionth, using the same resources. In that sense, streaming is scalable. Yes, you have to invest in some local content, but a lot of people will happily watch The Witcher or Avengers. The marginal cost of a user in Tbilisi is the same as Toledo, so it scales.

Some hybrid business models, however, do not scale. As you will see.

The Western Front

All is not quiet on the western front. This is where the battle is joined but, as you’ve seen above, it’s not yet a war. Most of the hot new streaming networks (and Hulu) are stuck in just America or a few western countries.

Disney and HBO aren’t limiting themselves to the western world out of choice, they just can’t move. They’re trapped by their own web of contracts. Disney, HBO, CBS, now NBC; these are all content suppliers, they sell content to distributors. They have contracts with distributors, and those contracts include exclusivity.

When Netflix started a war with its suppliers, it was risky, but the advantage is that these companies are all constrained by their legacy business models. It will take them years to adapt and in some cases will be culturally impossible.

For these suppliers to go to war with Netflix they have to, in turn, go to war with their own distributors — the local stations and cable/satellite companies that pay them. Instead of watching CBS on your local affiliate, you’re going to be watching direct, which is a problem. It’s a problem for those affiliates, and its a problem for your own internal sales team. You end up in a knife fight with yourself.

HBO has really struggled with this. While launching HBO Max, they also gave exclusive content rights to Sky in much of Europe and Bell in Canada. This means HBO Max cannot launch there. Their own sales team locked them out of important markets for years.

The streaming wars cannot be fought with one foot in legacy TV, but none of these big legacy companies can really take that risk. No board is going to be like, ‘OK, dump all of your revenues.’ That takes a lot of corporate cojones.

The same goes for CBS, NBC, and other channels. They may have compelling content, but they contractually have to shut the door on billions of consumers. They literally will not take my money, which is not a good way to compete.

These legacy firms will roll out, but in a half-assed way. Internally, they will be pulled in two directions — traditional sales will want to keep distributors happy, and the digital team will want to cut them out. Without clear leadership, this leads nowhere.

Of all these companies only Disney is being adequately aggressive. They’re planning to roll out to Western Europe over summer 2020, Eastern Europe by fall, Latin America around the same time and the Asia Pacific over the next two years.

Most importantly, they have hulk-smash content — Marvel, Star Wars, Frozen, Lion King. This is content that people love and can understand in any language. And of course, they have the killer app for any streaming service. You can put your kids in front of Disney and they’ll shut up.

The Eastern Front

All is quiet on the Eastern Front, in the sense that no one can get in. The Chinese video streaming market is older, better, and more diverse than anywhere else. Their big digital companies Baidu, Tencent and Alibaba all have strong video offerings — iQiyi, Tencent Video, and Youku, respectively.

While they import Japanese and Korean content, these companies have mostly been content to only serve customers in China. They are dipping a few toes in the water, mainly in South East Asia. iQiyi is starting in Malaysia, but through the distributor model. Tencent is going direct to consumer in Thailand, but these are tentative, baby-steps. None of these companies are showing signs of the cultural lobotomy required to become an international competitor.

The main advantage that these Chinese companies have is a huge regulatory moat around their main market. They can evolve in peace because everyone else has to stay out. Their growth, however, is slowing and they do need users from somewhere. It’s entirely possible that some long-form TikTok could one day take the whole market by surprise. Don’t underestimate the power of Asian teledramas.

Netflix’s Secret Weapon

Right now Netflix has the geographic advantage. They have the higher ground and a lot of ammunition. Most players are stuck on the Eastern or Western front and the few global players just aren’t as good. Where I live Netflix has been around for four years and has become a verb. That’s their secret weapon.

The reason they have this advantage, however, is not luck. It’s culture. No other company is capable of as much internal change as Netflix. Netflix is only here because it murdered its darlings. They killed the DVD business to go into streaming. They pissed off their suppliers to produce content. And they said no to distribution deals to invest in their own platform. Very few companies are capable of this level of creative (and cash) destruction, and very few boards are as tolerant.

Netflix is going to need its culture, because the geographical advantage is going to wear off. Troops are moving, and they have Baby Yoda.

Netflix’s Weaknesses

Netflix’s competitors have deep pockets, which buys them time. Netflix started original content in 2013 and went international in 2016. Hence it’s competitors could take 3–5 years to expand. Since they can bear the losses, they will, and if Netflix stays still they’ll die.

Streaming isn’t an incredibly sticky product, and people will go to extreme lengths for an excellent show. One hit is enough to drive subscribers to a new platform. As Outkast says, you’re only as funky as your last cut. Netflix’s weakness is that geography isn’t a permanent moat. Once your enemies finally show up, you’re in trouble.

The Future?

For now, however, the secret weapon is working. Netflix is taking serious damage in America but covering it up with international growth. Baby Yoda is culturally huge but legally constrained.

In the long term, however, Disney will expand and deploy the full force of Marvel, Star Wars and endless reboots of kids programming. Amazon Prime will survive off bundling. I think the networks are half-in/half-out and will die. HBO has no strategy, and lost their leader to Apple. I’d put my money on Apple being the next HBO over HBO being the next HBO.

These are all formidable competitors, and at some point, the good ones will be global. The secret weapon is not a secret anymore. In a few years, we should see the streaming wars going from a continental skirmish to a full-blown world war.

Get your popcorn.