How Elon Musk’s Wealth Isn’t Real

There is a real economy and an unreal economy. Confusingly, the unreal one is called just ‘the economy’ and the real one is generally ignored. Understanding this distinction is crucial to understanding how fucked we are, and where we need to be.

Unreal Engine

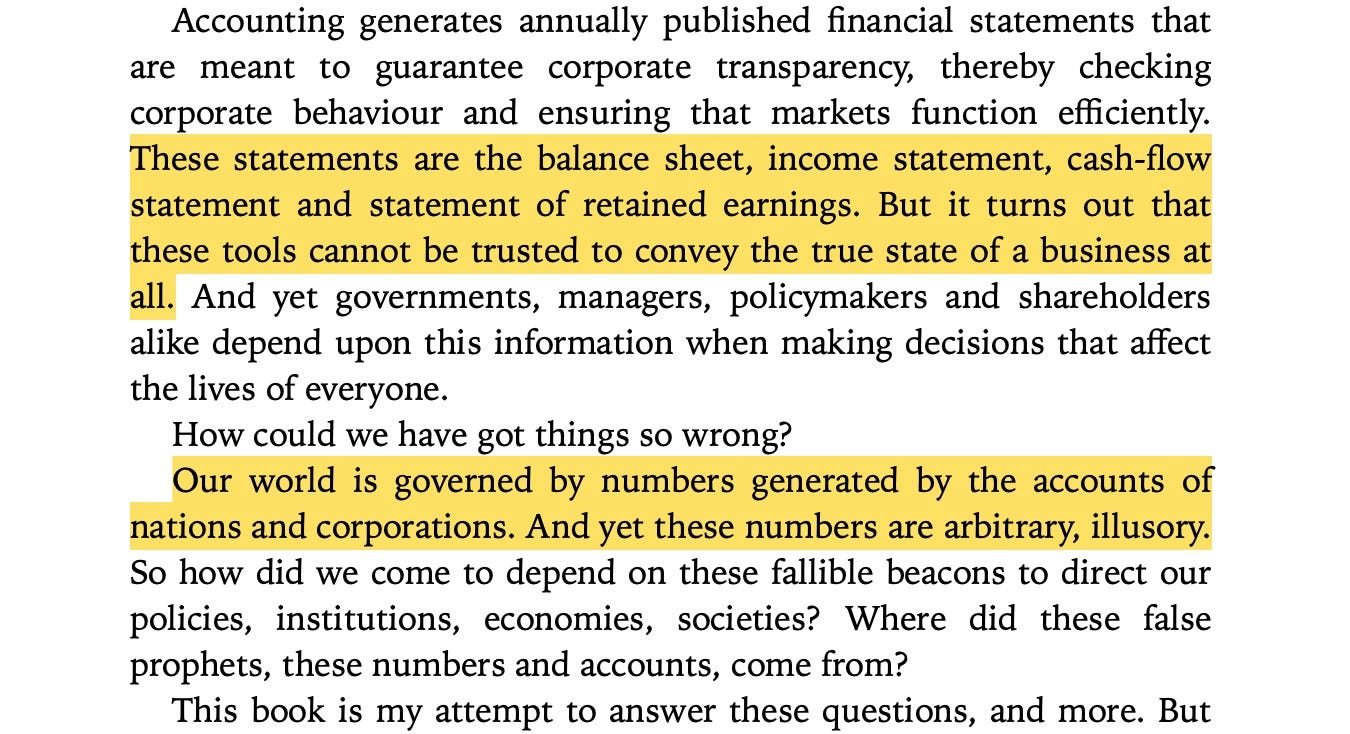

The unreal economy is all the markets, GDP figures, and most of the metrics we use to measure reality. They say you get what you measure, and what we measure is unreality. To understand this, just look at the wealth of the ‘world’s richest man’. It’s not real.

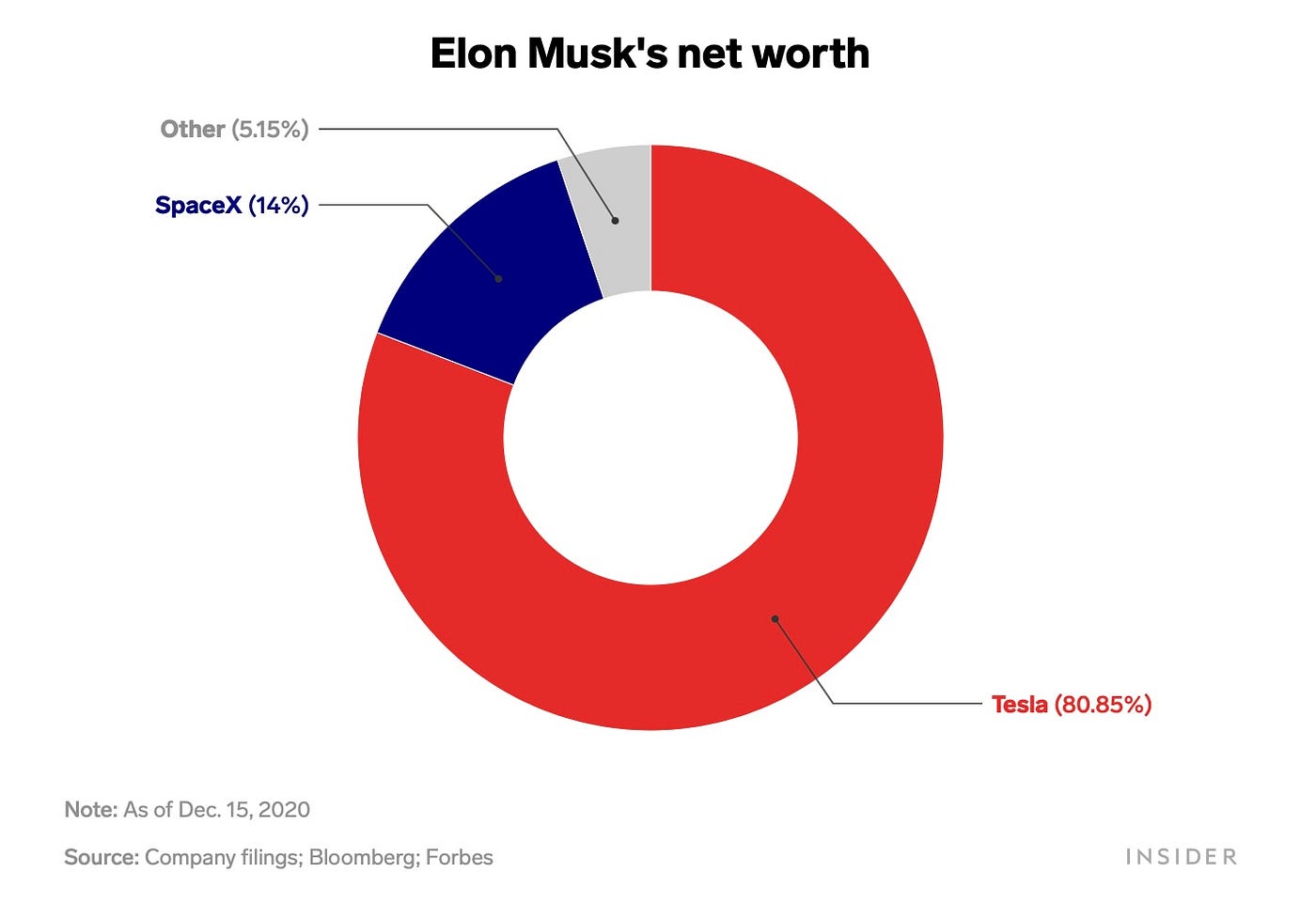

Elon Musk’s ‘wealth’ of $265 billion is almost all stock, most of it Tesla. Tesla, however, has never paid a dividend. It has never given shareholders any cash at all. Let’s have a look at Tesla’s latest earnings statements (Q1 2022) to see what this ‘wealth’ actually is.

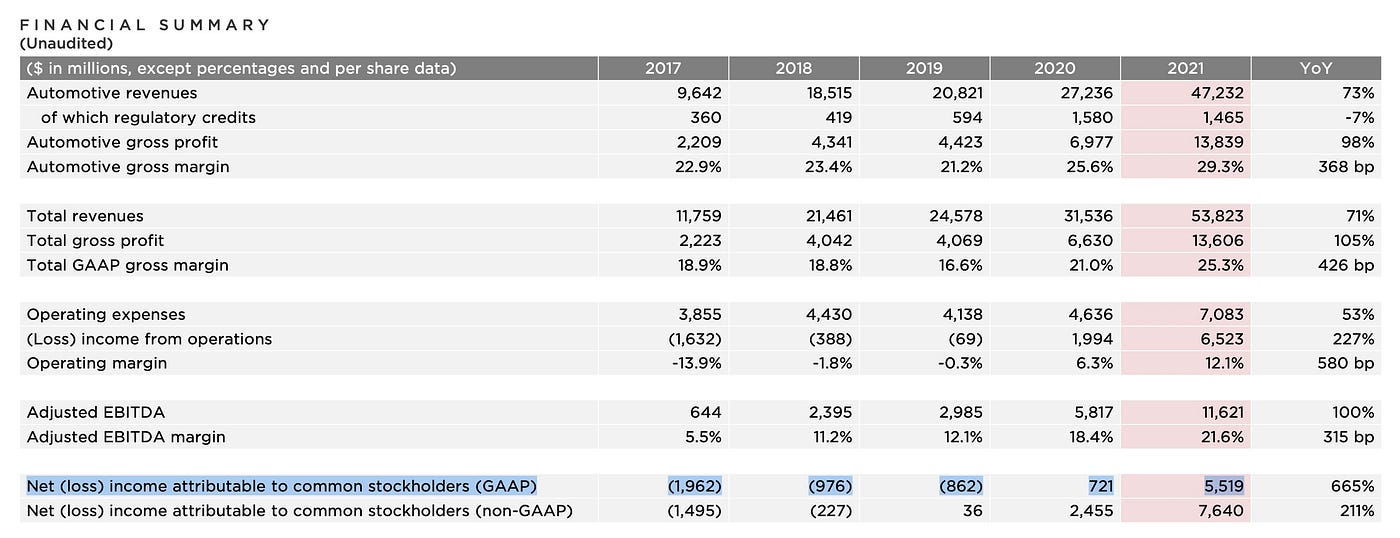

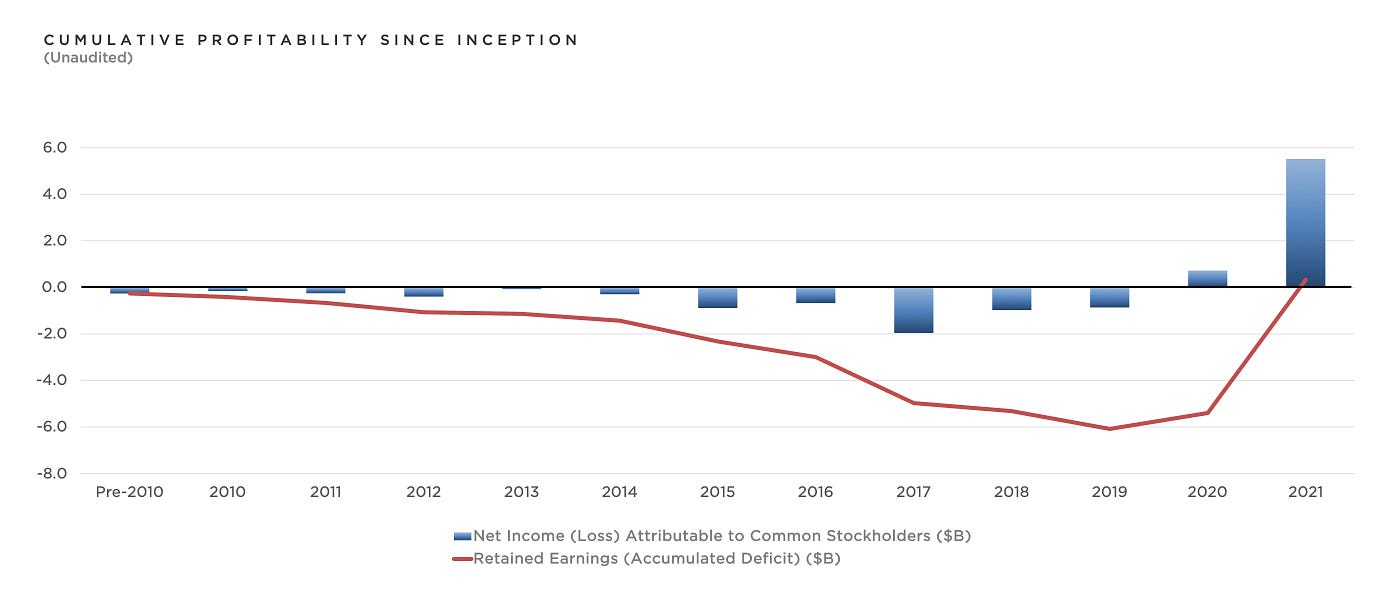

In 2021, the net income attributable to stockholders (like Musk) was $5.5 billion. You can actually see two figures there, one using GAAP (generally accepted accounting principles) and one that’s even more unacceptable. It’s important to understand that both of these numbers are unreal.

To understand that, however, we need to go back to the Renaissance, when the accounting of Musk’s wealth really started.

Luca Pacioli Sleeps With The Fishes

People from Iraq to China have been ‘accounting’ forever, merchant ledgers are some of the oldest known forms of writing. Capitalist accounting, however, is a whole-ass Renaissance art.

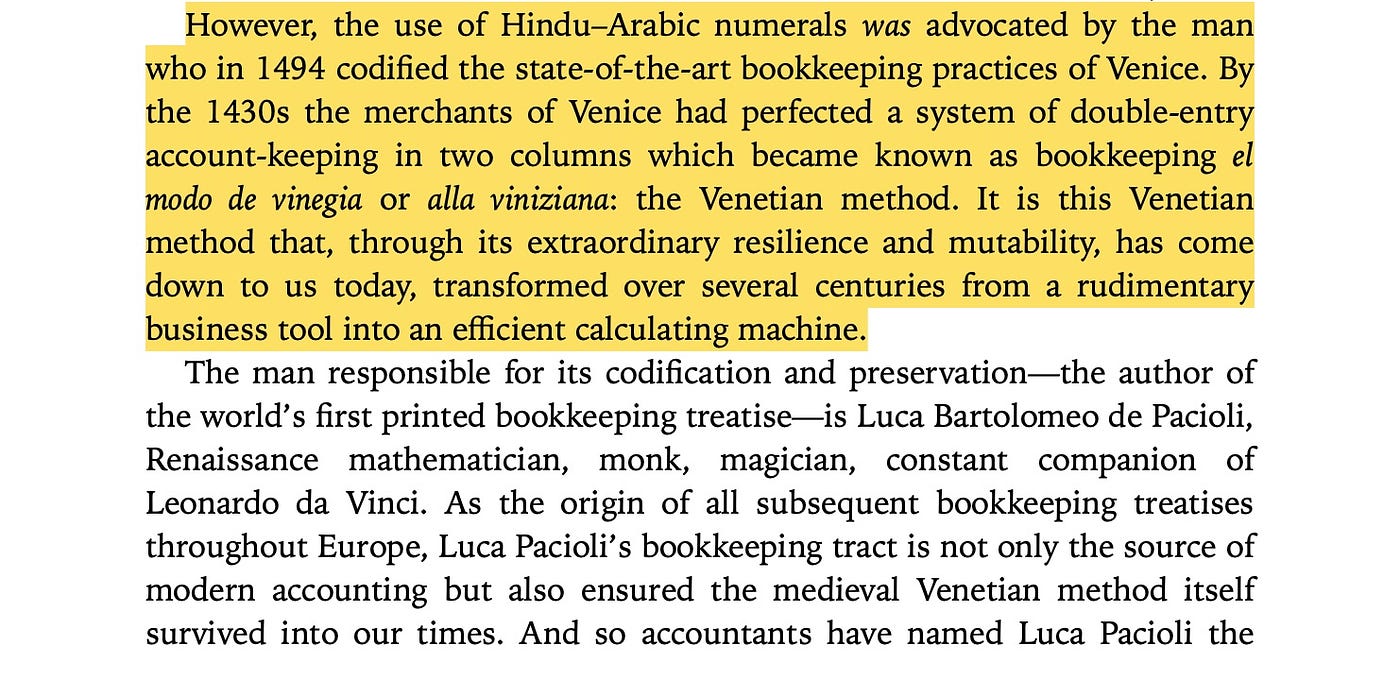

Luca Pacioli, Leonardo Da Vinci’s math tutor and homie, codified modern accounting in the 1494. The art may have come via India or the Muslim world (along with Hindu-Arabic numerals), but I’ll refer to Pacioli here. Not only did he advocate using numbers as we know them, he codified the same system that lets us ‘know’ Elon Musk’s wealth today.

Pacioli’s ‘Venetian method’ was used by merchants who literally had goods on boats. Those boats could sink, they could come in, or they could get stolen. Keeping track of this shit was no joke. Jane Gleeson-White describes the tribulations of one merchant, Francesco Datini, in detail, through his thousands of letters and hundreds of account books.

“Like Shakespeare’s merchant of Venice, Datini worried constantly — about his merchandise, about the safety of the ships that carried his wares, about the health of the sailors, the threat of pirates, the ravages of the plague. Towards the end of his long, healthy and prosperous life, Datini wrote to his wife: ‘Destiny has ordained that from the day of my birth I should never know a whole happy day.’”

Whereas working people think of wealth as cash on hand, ‘cash’ is just one entry in an accounting book. Datini could have 10,000 florins in Florence, but 10,000 florins worth of armor on a boat, and he had to account for both. Counting tells you what ships have come in. Accounting tells you about the ship that’s yet to come. This is an important method for ‘perceiving’ complex business dealings, but as you can see, it’s inherently prone to being wrong.

At the end of the day, you simply don’t know if your ship will come in. That’s why Renaissance accounting books, including Datini’s, were almost always dedicated to God.

As Gleeson-White says, connecting it to the modern day:

Now let’s return to Elon Musk’s numbers, as the personification of the unreal economy today, and everything wrong.

Unreal Wealth

Today we have Elon Musk ‘worth’ $265 billion based mostly on a company which has retained earnings of less than $500 million. That is to say, in 18 years of operations the company has lost money every year except two, digging them just barely out of the hole. The legally-adult company has earned only $500 million total. This is less that one day of Amazon profits, but Musk is somehow worth more than Bezos.

How is this so? Because investors are betting not on ships that have come in, but ships that are yet to come. And they’re betting on other people believing in the same thing. You can see how this speculation spirals, ad absurdum.

Thus you have a car company with less revenue than Hyundai, valued higher than every other car manufacturer—people producing many more cars and certainly more cash. Thus you have a man who’s wealth is not in his hand, but in other people’s minds. Elon Musk’s wealth is their belief that his ship will come. There’s no real cash or cars to justify it. It’s just the belief that there’s something over the horizon.

The Unreal Economy

This is not just Musk. He is just the personification of values gone terribly wrong. Elon Musk digging up lithium and steel to produce vehicles wildly more inefficient than a train is not solving climate collapse. Indeed, he is the system bringing the climate crashing down.

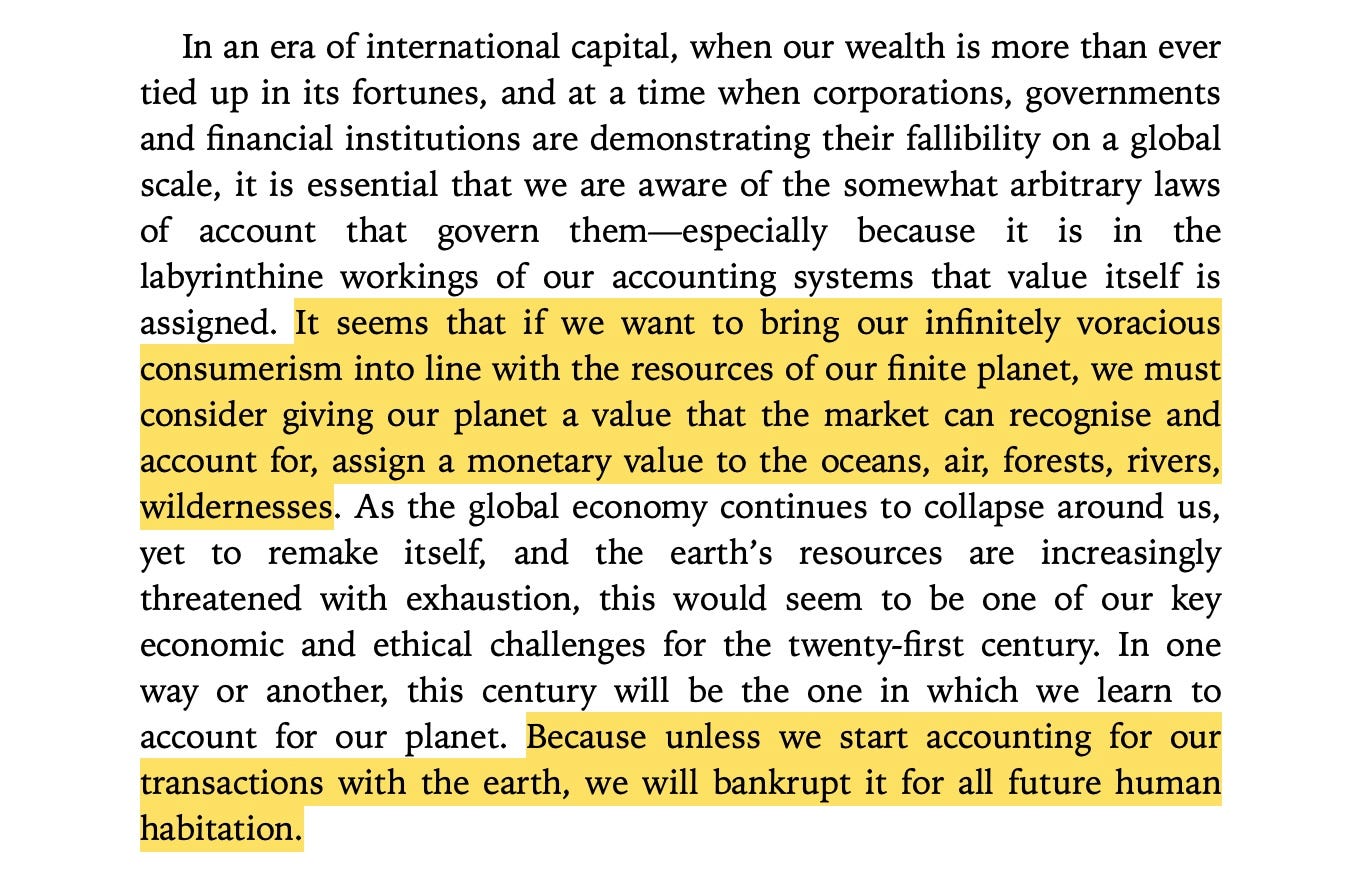

As Gleeson-White says, “it seems that if we want to bring our infinitely voracious consumerism into line with the resources of our finite planet, we must consider giving our planet a value.”

Gleeson-White calls for an ‘eco-accounting’ which I think is practical but not perhaps radical enough. While I’m not sure about the solution, she’s definitely right about the problem. As I keep saying, look around. Is luxury cars for the 1%, creating paper wealth for the .00000001% the way out? Or is it just the way down?

Is rich people betting on other rich people actual wealth, or do we need to actually feed people, educate children, care for the Earth, and measure what really counts? As Gleeson-White discusses, the accountant’s green-eyeshades have made everything look like money, but as every prophet and philosopher has told us, that’s not what life is about. Indeed, it’s how life comes undone.

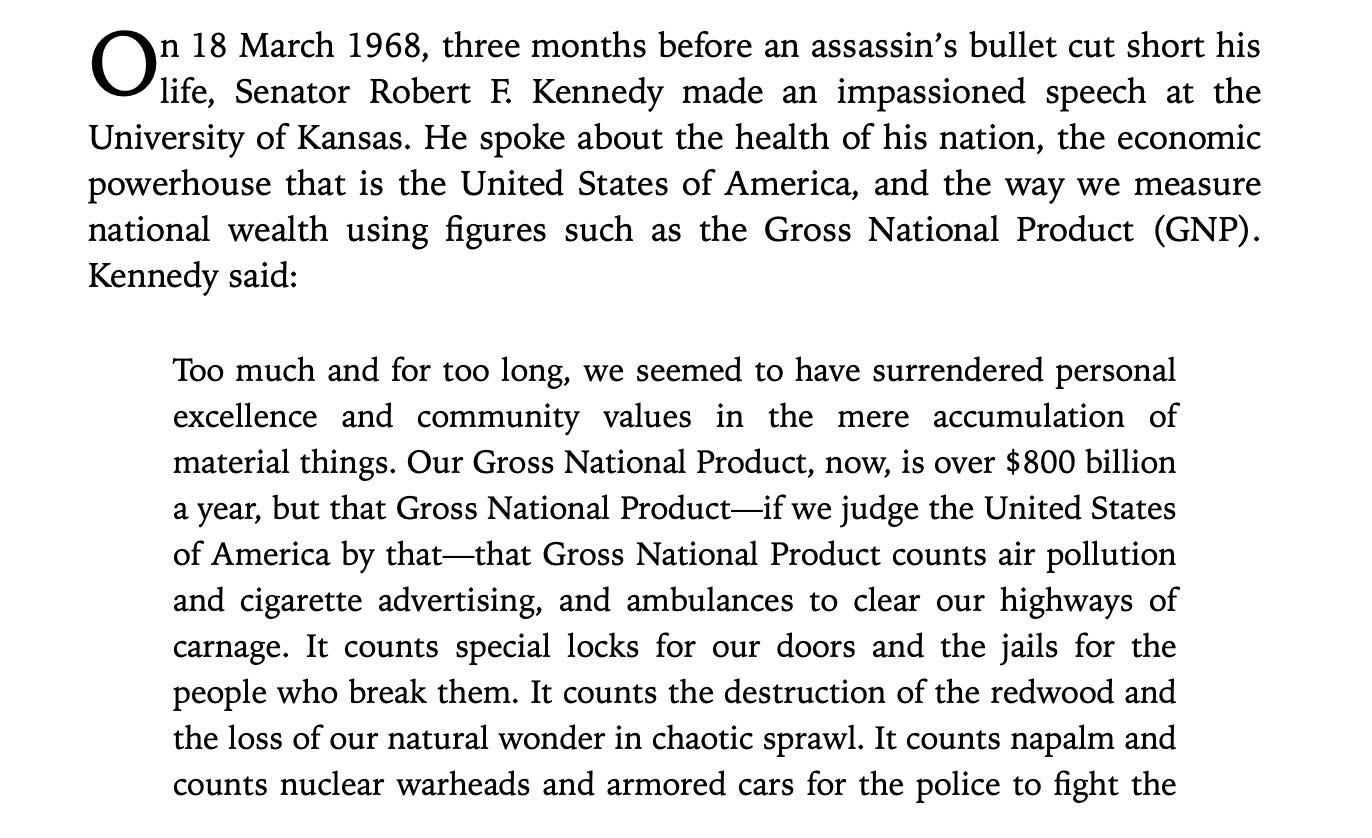

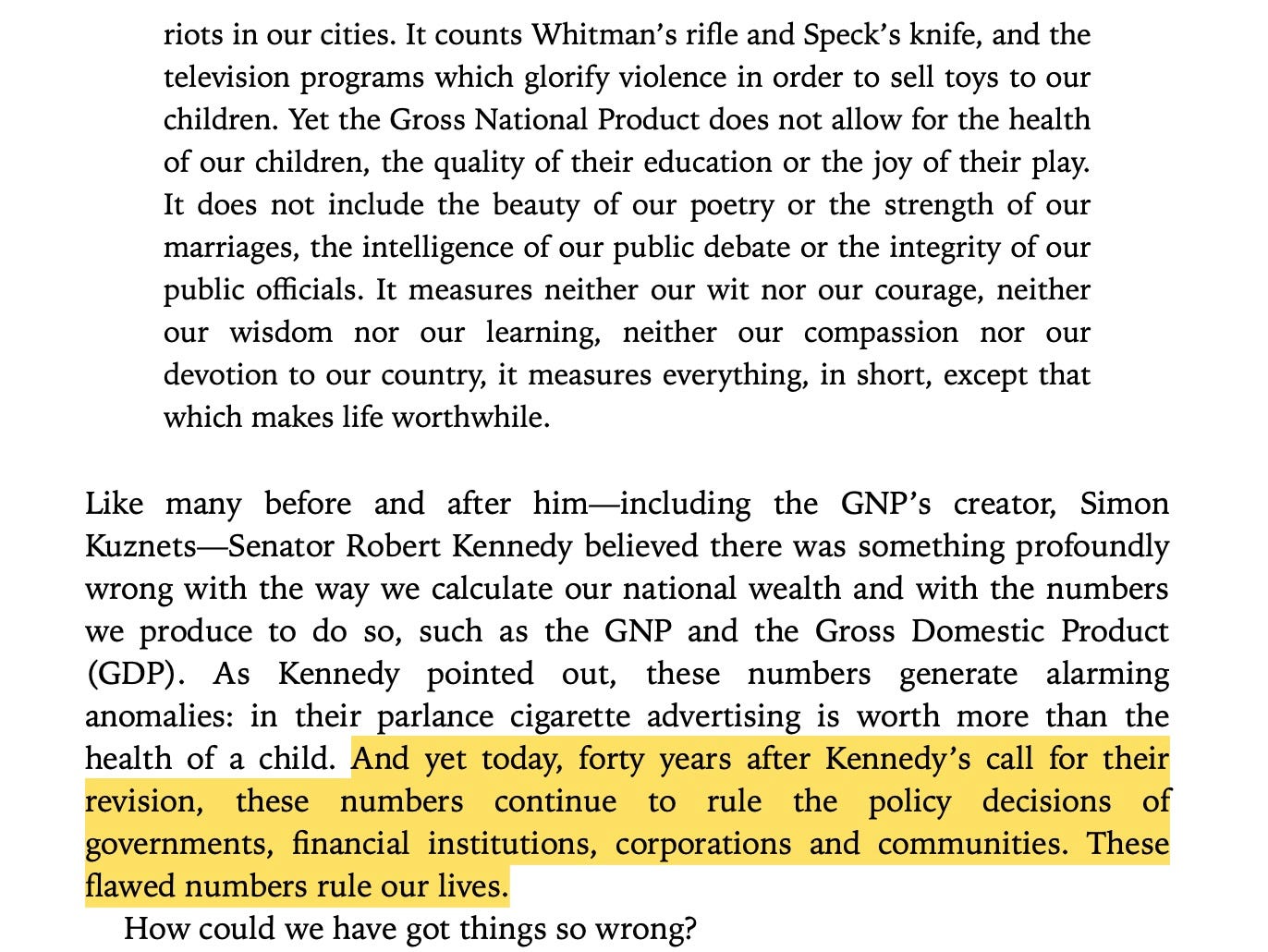

I’ll repeat Gleeson-White’s intro at length because it bears repeating. She’s talking about GNP (the precursor to GDP), and how accounting—which is completely unfit for this purpose—has come to account for the wealth of nations. She quotes Bobby Kennedy, a few months before he got shot.

When you just look at Elon Musk ‘valued’ as the richest man in the world, you have to ask. How could we have got things so wrong? Wealth is a measure of what we value, and what do we value? Unprofitable companies? Charlatans like Elon Musk?

Musk doesn’t even not make the most stuff, or make the most money, he just makes people believe that his ship is about to come. For 18 years, it’s been just over the horizon. And this isn’t just him, this is the whole ‘market’, selling not produce now but the promise of produce in the future. While people go hungry all around. While the very Earth goes down.

The whole stock market is just rich peoples beliefs about the future, which everyone from scientists to the indigenous say is actually running out. And these beliefs are all that makes Musk the ‘richest man in the world’. We value the ideaof saving the Earth more than the Earth itself. That’s what Musk is the personification of.

Therefore it’s not just Musk. He’s just holding investors over the side off the Titanic, having a last bit of fun. The problem is bigger one conman. This whole thing we call ‘the economy’ is a long con.

The problem is not just that Elon Musk’s ship won’t come in, I don’t care, those investors can all take a bath. The problem is that the oceans are rising and every port we know will be gone. There won’t be safe harbor for anyone. That’s what we’re facing today and we don’t even measure it in any way that accounts.

That’s why desperately need to plan a real economy now. Because the unreal one is destroying the reality we depend on. So what is a real economy? We’ll get to that anon.

Similar idea, but in general and more ranty: The Richest Men Are Not Really Rich. The book Double Entry is really good, a fascinating history of accounting, which is actually really cool (Buy/Borrow).