Bitcoin Has Become A Victim Of Its Own Success

Bitcoin was supposed to be a rebellion against traditional finance, but now it’s another asset class. It was supposed to cutout bankers and middlemen, but it’s just created new ones. It was supposed to be a fuck you to central bankers, but now it’s tethered to interest rates like everybody else.

In everything it set out to do, Bitcoin has been a failure, but it’s somehow been a success. They made money and that excuses everything else. But now the money is running out and the excuses are wearing thin. People went along with all the bullshit as long as it made money, but now it’s starting to smell.

Bitcoin is crashing faster than the investments it was supposed to hedge against. Bitcoin has spawned new financial crooks that are destabilizing it and everything else. In these two big ways, BitCoin has become a victim of its own success.

Traditional Finance

Bitcoin was supposed to be an escape from financial institutions. The first line of Satoshi Nakamoto’s white paper announces Bitcoin as:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

Basically none of this happened. Bitcoin is not used as cash for payments, it’s hoarded as an asset, and most of that speculation is through institutions.

Institutional investors have gone from accounting for 20% of Bitcoin trading in 2018 to 70–80% in 2021. This has been a blessing for Bitcoin’s respectability, but respectability was what they were rebelling against! All of their power came from the dork side of the force, and they’ve gone to the dark side.

First of Morgan Stanley has a lead cryptocurrency analyst now, and this is what she (Sheena Shah) says:

In 2018, retail investors [individuals, ie ‘peers’] were dominant in crypto markets, participating in 80% of trading volumes on Coinbase, the large crypto exchange. Today, the story couldn’t be more different, with only 1/4 of trading volumes on Coinbase being with retail investors.

Institutions, and more specifically crypto institutions, appear to have taken over, many of which are simply trading with each other. We think retail investors are more likely to buy and hold, but institutional investors are willing to both buy and sell crypto, if it means they can make a return.

And because institutional investors are sensitive to the availability of capital and therefore interest rates, they trade crypto somewhat in sympathy with the way equities are traded. This shift in the type of market participant is key to understanding why crypto markets are selling off at the same time as the equity markets are experiencing a downturn.

The relationship was great while markets were going up, but when markets started going down, Bitcoin suddenly started going down along with them, except faster. Bitcoin enthusiasts were happy when financial giants like BlackRock and Guggenheim started buying in, it validated them, but they didn’t get it. Those guys weren’t buying in, Bitcoin was selling out. They were part of the same financial fuckery now. As Yoda said, “Once you start down the dark path, forever will it dominate your destiny.”

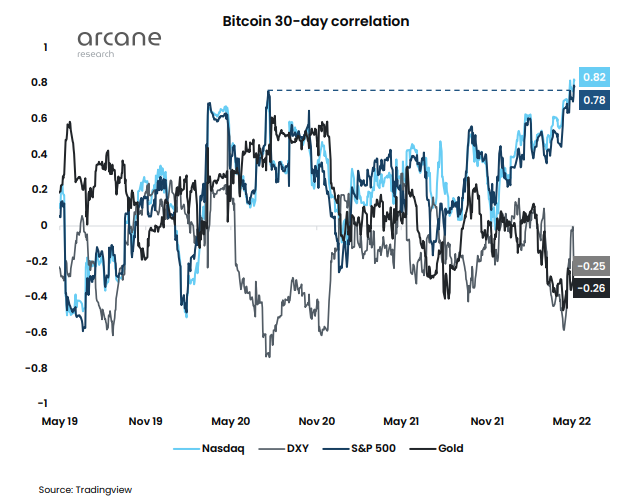

As the chart below shows, Bitcoin went from having not much correlation with the stock market to becoming quite correlated around 2020. The relationship is only dipping now because Bitcoin is performing worse.

When things get shaky, these institutions have no religious belief that Bitcoin is going to go to the moon. It’s the first thing they sell. As a report from Genesis Trading says:

For many institutional investors, BTC is a high-volatility diversification asset rather than a longer-term store of value. Hence, in periods of uncertainty, it enters and exits funds along with other high-volatility assets, with risk reduction taking precedence over the need for diversification. The size of institutional flows entering and exiting the market has a greater impact on BTC’s price than the accumulation activity of longer-term investors, tying BTC’s performance to that of the market as a whole.

These heathens are now moving the market, while the old hodlers clutch onto their coins like a rosary that keeps getting smaller and smaller. Even the pure crypto institutions are often levered up the ass to traditional banks and sometimes they have to sell. Even laser-eyed zealots like Michael Saylor (and Microstrategy) have been hit by margin calls and they either have to sell or put up collateral.

Far from being “a purely peer-to-peer version of electronic cash”, Bitcoin is now almost purely institutional speculation. And we know how that goes. Hence it’s crashing along with everything else.

Decentralized Finance

Bitcoin is crashing worse than everything because it has other problems beyond Wall Street. Dumbasses from the old neighborhood are bringing it down as well. Other crypto-currencies, dubious crypto banks, NFTs, outright scams; a run anywhere can start a run on Bitcoin itself.

And I never get to lay back

’Cause I always got to worry ‘bout the payback

Some buck that I roughed up way back

Coming back after all these years

“Rat-a-tat-tat-tat-tat!” That’s the way it is

Bitcoin was so successful that it spawned a million copycats, dozens of exchanges, and an entire ecosystem to rival Wall Street in unscrupulousness. Now a crash among any of those fuckers can provoke a run on the whole place, and often does.

For example, the crash of the UST ‘stable’ coin and Luna coin was bad for Bitcoin. The run on the crypto bank Celsius directly affected them. When even Binance paused withdrawals, it spooked the silly out of everyone. One shot and all you see is asses and elbows running, and right now it’s shot’s all around. It’s not a question of whether something will cause a run. It’s which one.

Getting Your Ass Handed To You

Hence Bitcoin is beset by risk on all sides. From its new asshole friends on Wall Street and from its old asshole friends from the hood. From the Feds it swore it would never fuck with to the crooks it was supposed to be engineered around. Bitcoin was supposed to an algorithmic ark to escape this very collapse, but instead they’re the first fuckers underwater. Honestly, it’s embarrassing.

Note that this isn’t a condemnation of Bitcoin or crypto itself. I think it’s bullshit as much as I think the joint stock company is bullshit. Every religion was once a cult. I also don’t think this will kill crypto, or even Bitcoin. I consider crypto artificial life (just like corporations) and as Jeff Goldblum says in Jurassic Park, “life finds a way.” Nature is always killing off most of what it creates, and Bitcoin’s regular 80% purges are evolutionarily ordinary.

My point is just that by whatever measure Bitcoin has been called a success, it’s failing now. It’s losing money, it’s in bed with the same jackals it was supposed to be overthrowing, and it’s waiting on the Fed to announce interest rates like all those ‘TradFi’ fools. Meanwhile, it’s spawned a new ecosystem of grifters and crooks, unleashed upon desperate individuals just trying to make it through.

It’s sad because underneath all the crypto greed is a real need. People were making nothing on their savings while big banks gambled for billions and got bailed out by the government. Meanwhile, people lost their homes and jobs and became debt peons for life. Printing your own money and saying fuck you was really appealing, but now everyone is even more fucked.

It’s hard because Bitcoin is also a religion for people—it gives them hope—but what’s happened is like when Christianity was adopted by Rome. That iconoclastic, anarchic faith ended up more Roman than Christian. In the same way, Bitcoin is ending up more Finance than Decentralized Finance, and it’s collapsing along with the rest of Imperium.

Further Reading

- How Bitcoin Is Hostile AI

- Corporations Are People And They’re Killing Us